Question: Q.1 with details please! 9. How should you value a project in a line of business with risk tHal is uilie ent than the average

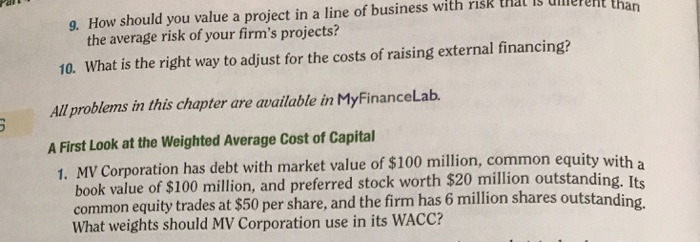

9. How should you value a project in a line of business with risk tHal is uilie ent than the average risk of your firm's projects? 10. What is the right way to adjust for the costs of raising external financing? All problems in this chapter are available in MyFinanceLab. A First Look at the Weighted Average Cost of Capital 1. MV Corporation has debt with market value of $100 million, common equity book value of $100 million, and preferred stock worth $20 million outstandin common equity trades at $50 per share, and the firm has What weights should MV Corporation use in its WAcc? with a g. Its 6 million shares outstanding

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts