Question: Q1. Your task is to design and implement an algorithm that searches a collection of documents. You have the freedom to select the data structures

Q1. Your task is to design and implement an algorithm that searches a collection of documents. You have the freedom to select the data structures and algorithms that you consider to be more efficient for this task. Of course, you will have to justify your decisions.

First, you will process the documents and store their content(i.e. words) in the data structures that you choose.

Second, each input query is a word. For each query, you will search it in the documents, using the previously implemented data structures and an algorithm of your choice.

Third, for each such query, you will have to display the documents that contain the query. The documents should be outputted in the order of query occurrence times in each document. The document containing the most query words should be the first to display.

Example

Consider the following sample documents.

Doc1:

I like the class on data structures and algorithms. This is a useful class.

Doc2:

I hate the class on data structures and algorithms.

Doc3:

Interesting statistical data may result from this survey.

Sample query: class

For the sample query, the output should be:

Doc1:

I like the class on data structures and algorithms. This is a useful class.

Doc2:

I hate the class on data structures and algorithms.

Note that Doc1 comes before.

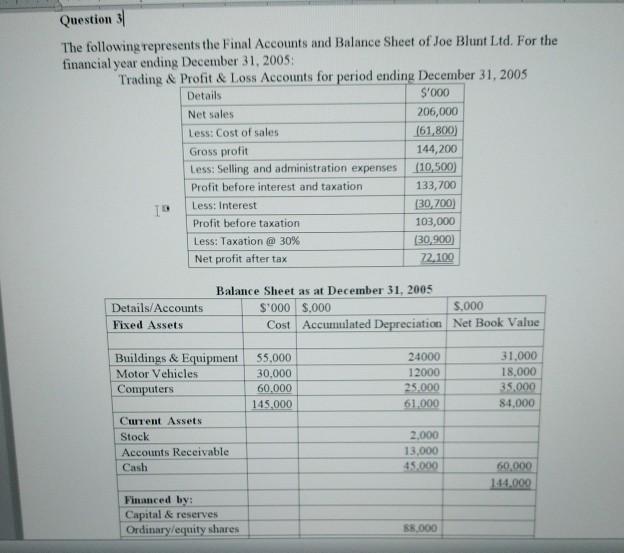

Q. 2

How would sale of $400 of inventory on credit affect the financial statement if the cost of the inventory sold was of $160.

It would increase cash by $400 on the income statement and increase revenue by $400 on the balance sheet.

It would decrease non-cash assets by $400 on the balance sheet and decrease retained earnings by $400 on the income statement.

It would increase non-cash assets by $240 on the balance sheet and increase retained earnings by $240 on the balance sheet.

It would increase decrease inventory by $400 on the balance sheet and increase revenue by $400 on the income statement.

During fiscal 2016, Shoe Productions recorded inventory purchases on credit of $337.8 million. The financial statement effect of these purchase transactions would be to:

Increase expenses (Cost of goods sold) on the balance sheet and increases liability (accounts payable) on the income statement.

Increase liabilities (Accounts payable) on the balance sheet and increase assets on the balance sheet.

Increase expenses (Cost of goods sold) on the income statement and increase liabilities (Accounts payable) on the balance sheet.

Decrease cash on the income statement and increase liability (account payable) on the balance

sheet.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts