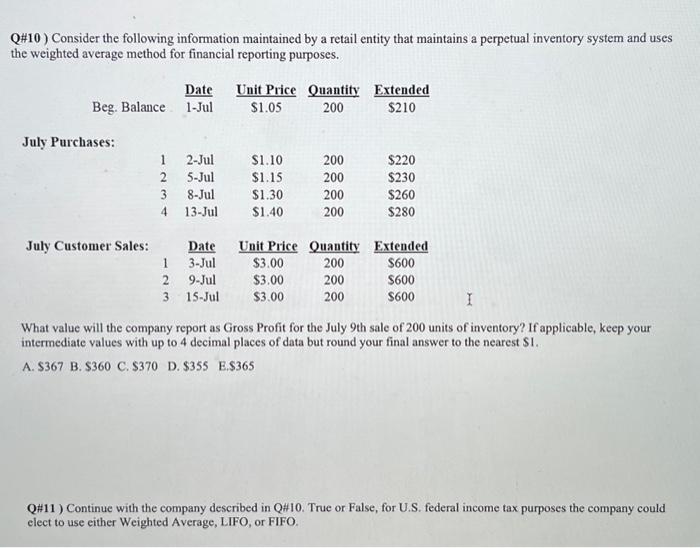

Question: Q#10) Consider the following information maintained by a retail entity that maintains a perpetual inventory system and uses the weighted average method for financial reporting

Q\#10) Consider the following information maintained by a retail entity that maintains a perpetual inventory system and uses the weighted average method for financial reporting purposes. What value will the company report as Gross Profit for the July 9 th sale of 200 units of inventory? If applicable, keep your intermediate values with up to 4 decimal places of data but round your final answer to the nearest $I. A. $367 B. $360 C. $370 D. $355 E. $365 Q\#11 ) Continue with the company described in Q\#10. True or False, for U.S. federal income tax purposes the company could elect to use either Weighted Average, LIFO, or FIFO. Q\#10) Consider the following information maintained by a retail entity that maintains a perpetual inventory system and uses the weighted average method for financial reporting purposes. What value will the company report as Gross Profit for the July 9 th sale of 200 units of inventory? If applicable, keep your intermediate values with up to 4 decimal places of data but round your final answer to the nearest $I. A. $367 B. $360 C. $370 D. $355 E. $365 Q\#11 ) Continue with the company described in Q\#10. True or False, for U.S. federal income tax purposes the company could elect to use either Weighted Average, LIFO, or FIFO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts