Question: Q10. Suppose that you have fully hedged your cattle on feed by trading December 2017 CME live cattle futures contract. You placed hedge on 02

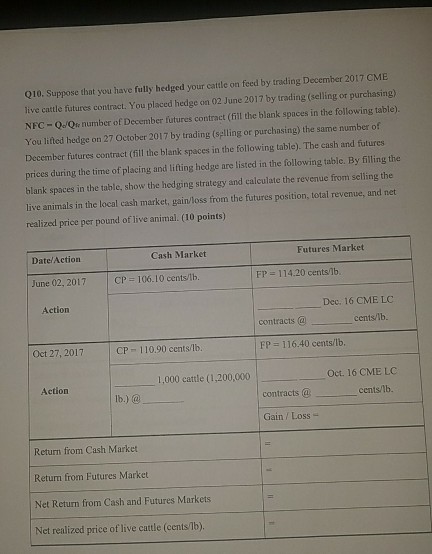

Q10. Suppose that you have fully hedged your cattle on feed by trading December 2017 CME live cattle futures contract. You placed hedge on 02 June 2017 by trading (selling or purchasing) NFC-QQ number of December futures contract (fil the blank spaces in the following table). You lifted hedge on 27 October 2017 by trading (selling or purchasing) the same number of December futures contract (fill the blank spaces in the following table). The cash and futures prices during the time of placing and lifting hedge are listed in the following tablc. By filling the blank spaces in the table, show the hedging strategy and calculate the revenue from selling the live animals in the local cash market, gain/loss from the futures position, total revenue, and net realized price per pound of live animal. (10 points) Date/Action Cash Market Futures Market June 02, 2017 106.10 cents/lb. FP 114.20 centslb Action Dec. 16 CME LC contracts @ cents/lb Oct 27, 2017 CP 110.90 cents/tb FP 116.40 cents/lb. 1,000 cattle (1,200,000 Oct. 16 CME LC Action contracts Q centslb. Gain Loss- Return from Cash Market Return from Futures Market Net Return from Cash and Futures Markets Net realized price of live cattle (cents/Tb)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts