Question: q12 5 pts D Question 12 A project has an upfront cost (t=0) of $10,000, and it produces annual FCF of $3,000 / year from

q12

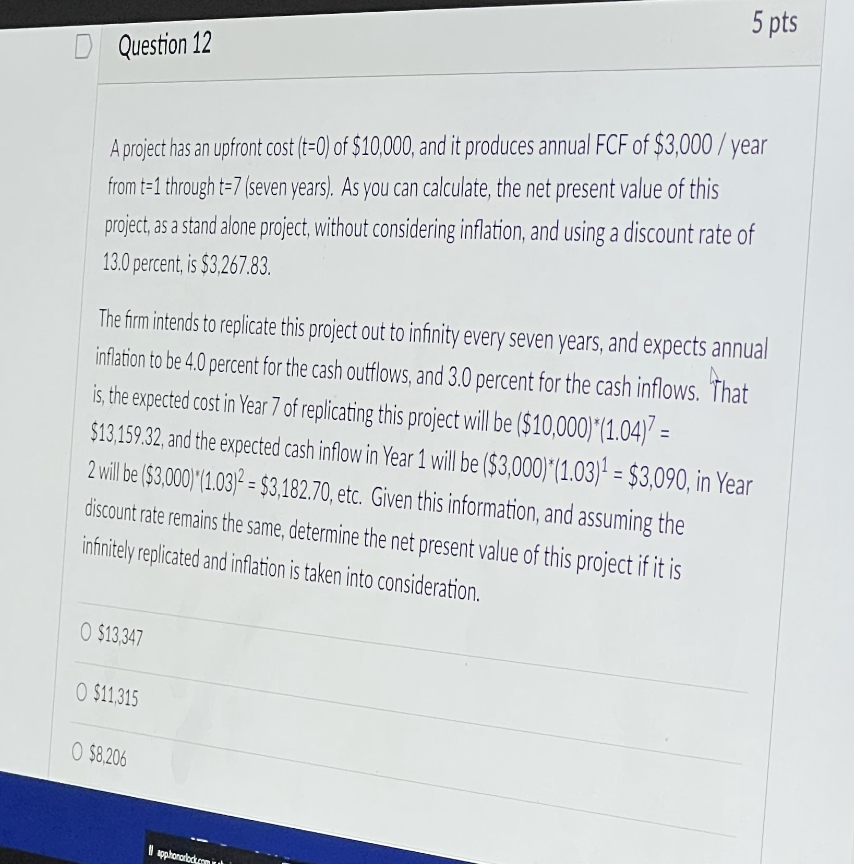

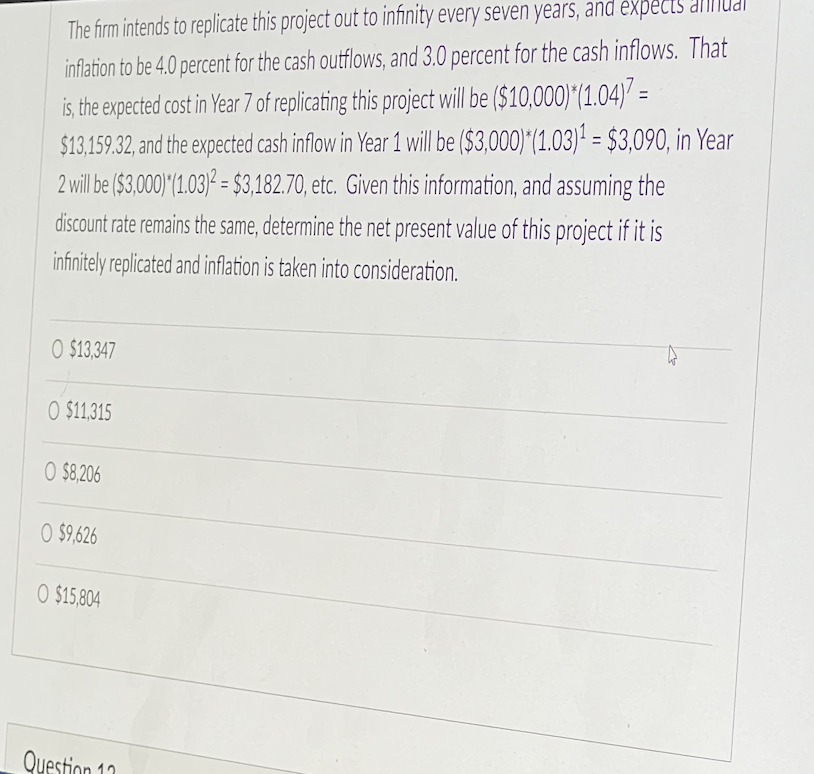

5 pts D Question 12 A project has an upfront cost (t=0) of $10,000, and it produces annual FCF of $3,000 / year from t=1 through t=7 (seven years). As you can calculate, the net present value of this project , as a stand alone project , without considering inflation, and using a discount rate of 13.0 percent, is $3,267.83. The firm intends to replicate this project out to infinity every seven years, and expects annual inflation to be 4.0 percent for the cash outflows, and 3.0 percent for the cash inflows. That is, the expected cost in Year 7 of replicating this project will be ($10,000)*(1.04) = $13,159.32, and the expected cash inflow in Year 1 will be ($3,000)*(1.03)4 = $3,090, in Year 2 will be ($3,000)|(1.03)2 = $3,182.70, etc. Given this information, and assuming the discount rate remains the same, determine the net present value of this project if it is infinitely replicated and inflation is taken into consideration. O $13,347 O $11,315 0 $8,206 upphoralocerami The firm intends to replicate this project out to infinity every seven years, and expects all inflation to be 4.0 percent for the cash outflows, and 3.0 percent for the cash inflows. That is, the expected cost in Year 7 of replicating this project will be ($10,000)*(1.04) = $13,159.32, and the expected cash inflow in Year 1 will be ($3,000)*(1.03)1 = $3,090, in Year 2 will be ($3,000)*(1.03)2 = $3,182.70, etc. Given this information, and assuming the discount rate remains the same, determine the net present value of this project if it is infinitely replicated and inflation is taken into consideration. O $13,347 O $11,315 0 $8,206 $9,626 O $15,804 Question 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts