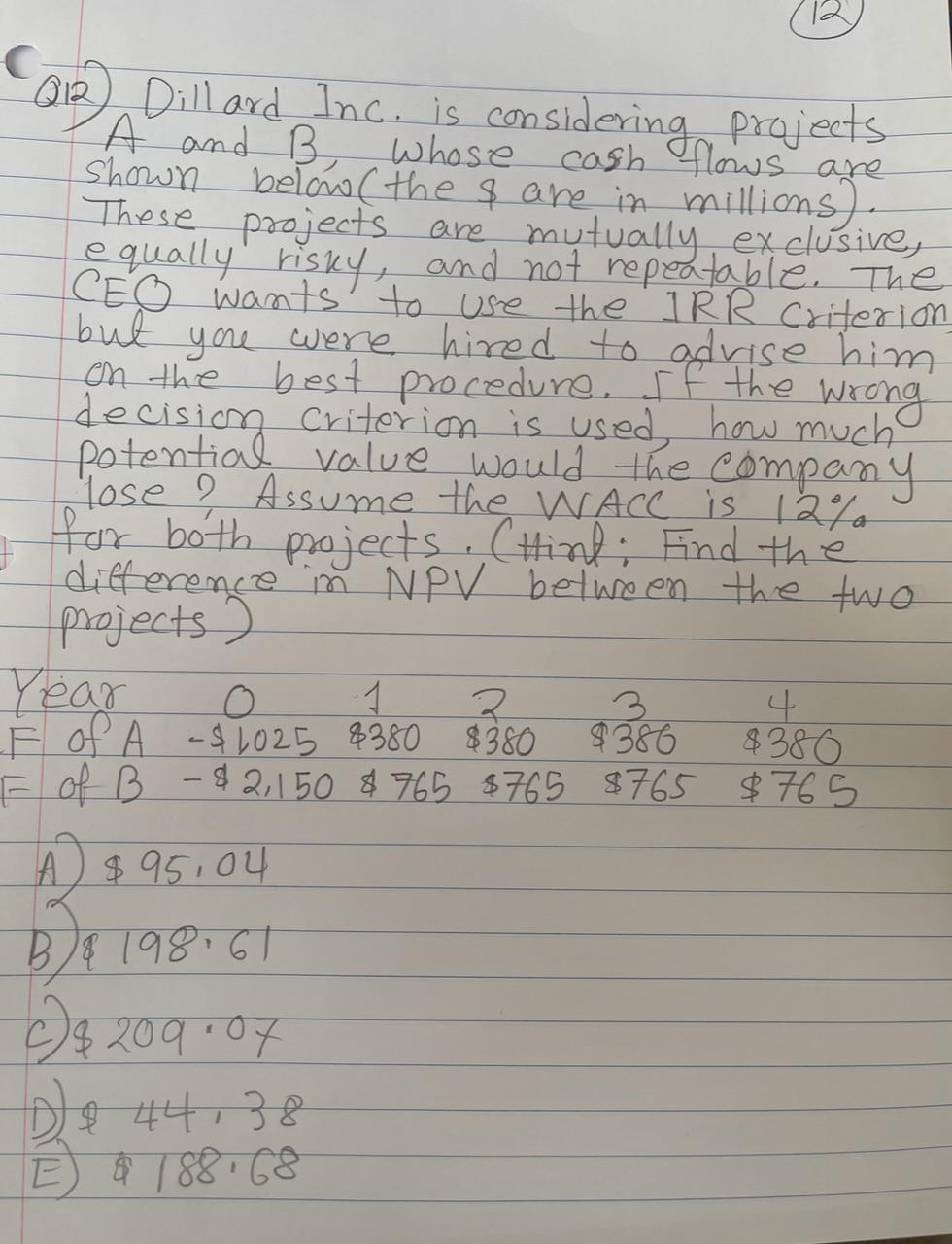

Question: Q12) Dillard Inc is considering projects A and B, whose cash flows are shown below. (the $ are in millions). These projects are mutually exclusive,

Q12) Dillard Inc is considering projects A and B, whose cash flows are shown below. (the $ are in millions). These projects are mutually exclusive, equally risky, and not repeatable. The CEO wants to use the IRR Criterion but you were hired to adrise him on the best procedure. If the wrong decision criterion is used, how much potential value would the company lose? Assume the WACC is 12% for both projects. (Hint: Find the difference in NPV between the two projects)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts