Question: Q.12 Please answer with the formula sheet 12. A $10,000 loan at 8.15% compounded quarterly is to be repaid by two payments. The first payment

Q.12 Please answer with the formula sheet

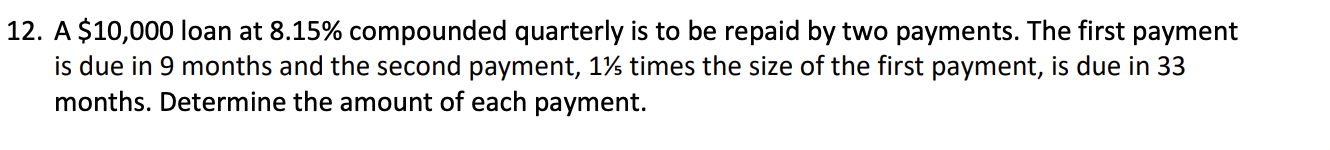

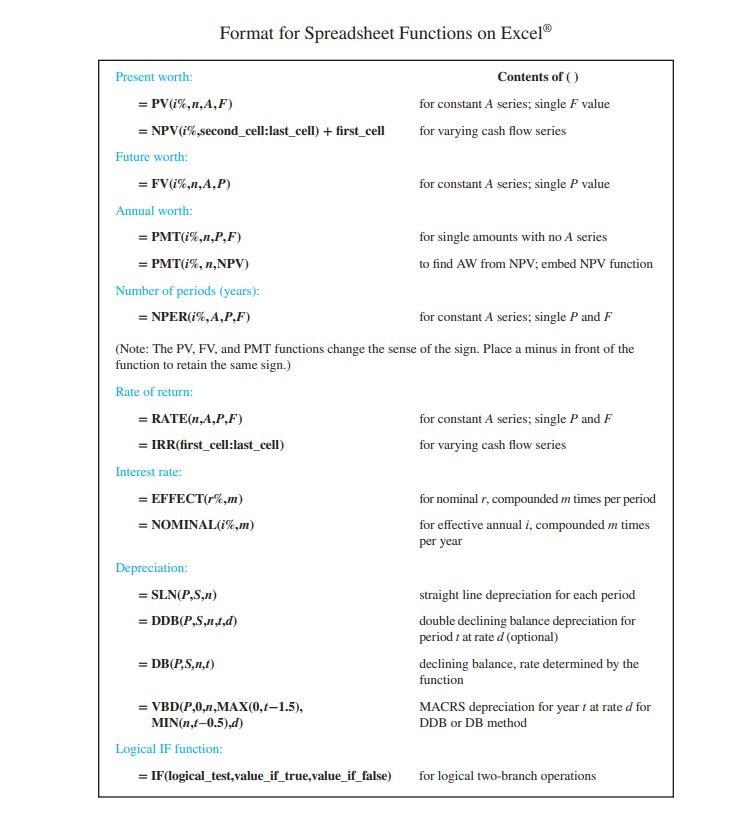

12. A $10,000 loan at 8.15% compounded quarterly is to be repaid by two payments. The first payment is due in 9 months and the second payment, 14 times the size of the first payment, is due in 33 months. Determine the amount of each payment. Format for Spreadsheet Functions on Excel Present worth: Contents of = PV(%,n,A,F) for constant A series; single F value = NPV (%.second_cell:last_cell) + first_cell for varying cash flow series Future worth: = FV(%,1,A,P) for constant A series; single P value Annual worth: = PMT(%,n,P,F) for single amounts with no A series = PMT(i%, n,NPV) to find AW from NPV; embed NPV function Number of periods (years): = NPER(%,A,P,F) for constant A series: single P and F (Note: The PV. FV, and PMT functions change the sense of the sign. Place a minus in front of the function to retain the same sign.) Rate of return; = RATE(n,A,P,F) for constant A series; single P and F = IRR(first_cell:last_cell) for varying cash flow series Interest rate: = EFFECT(r%,m) for nominal r, compounded m times per period = NOMINAL(i%,m) for effective annual i, compounded m times per year Depreciation: = SLN(P,S,11) straight line depreciation for each period = DDB(P,5,n,1,d) double declining balance depreciation for period t at rated (optional) = DB(P,S,n,1) declining balance, rate determined by the function = VBD(P,0,1,MAX(0,t-1.5), MACRS depreciation for year t at rated for MIN(n,t-0.5),d) DDB or DB method Logical IF function: = IF(logical_test,value_if_true,value_if_false) for logical two-branch operations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts