Question: Q1.3 Question 1.3 4 Points All else being the same, at expiration, a short position in a put option on ordinary shares will have lower

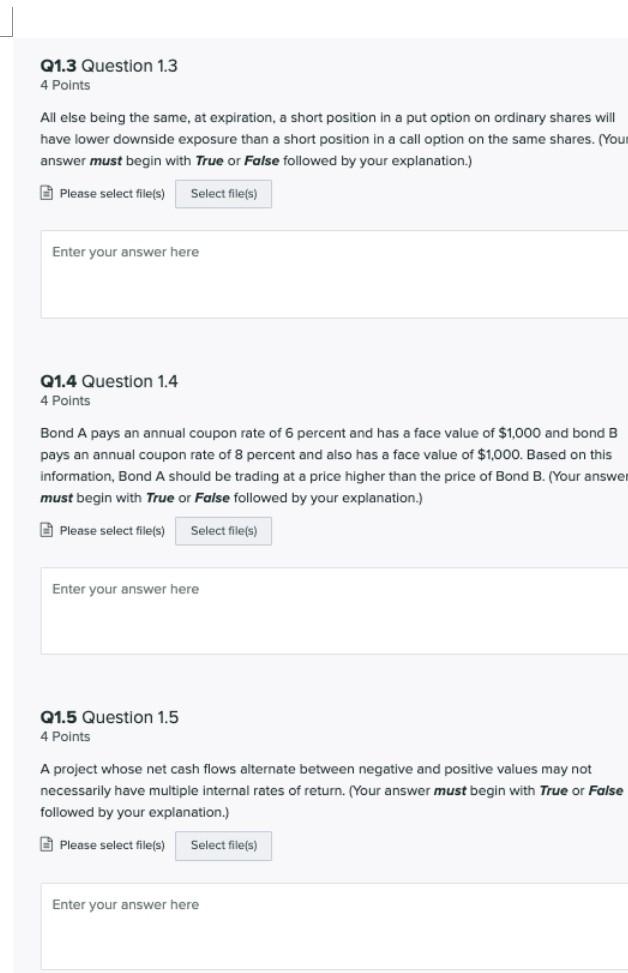

Q1.3 Question 1.3 4 Points All else being the same, at expiration, a short position in a put option on ordinary shares will have lower downside exposure than a short position in a call option on the same shares. (Your answer must begin with True or False followed by your explanation.) Please select file(s) Select file(s) Enter your answer here Q1.4 Question 1.4 4 Points Bond A pays an annual coupon rate of 6 percent and has a face value of $1,000 and bond B pays an annual coupon rate of 8 percent and also has a face value of $1,000. Based on this information, Bond A should be trading at a price higher than the price of Bond B. (Your answer must begin with True or False followed by your explanation.) Please select file(s) Select file(s) Enter your answer here Q1.5 Question 1.5 4 Points A project whose net cash flows alternate between negative and positive values may not necessarily have multiple internal rates of return. (Your answer must begin with True or False followed by your explanation.) Please select file(s) Select file(s) Enter your answer here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts