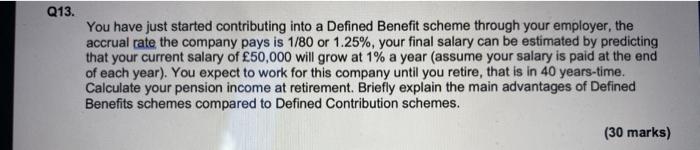

Question: Q13. You have just started contributing into a Defined Benefit scheme through your employer, the accrual rate the company pays is 1/80 or 1.25%, your

Q13. You have just started contributing into a Defined Benefit scheme through your employer, the accrual rate the company pays is 1/80 or 1.25%, your final salary can be estimated by predicting that your current salary of 50,000 will grow at 1% a year (assume your salary is paid at the end of each year). You expect to work for this company until you retire, that is in 40 years-time. Calculate your pension income at retirement. Briefly explain the main advantages of Defined Benefits schemes compared to Defined Contribution schemes. (30 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts