Question: q16: required : prepare the FIRST (operating) and the SECOND (investing) section of the statement of cash for the year ended dec31,2021 The following comparative

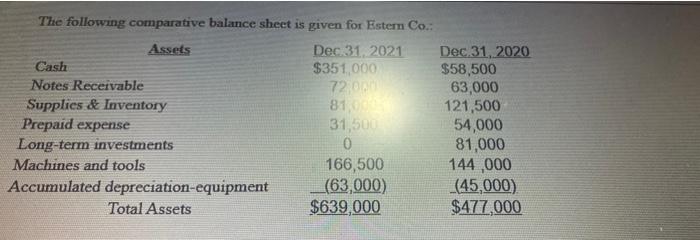

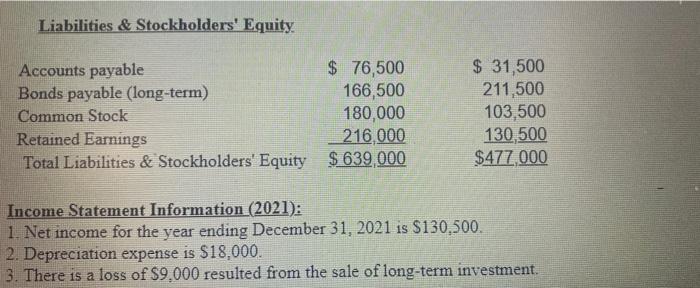

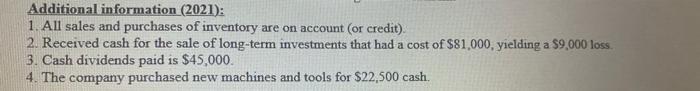

The following comparative balance sheet is given for Estern Co.: Assets Dec 31, 2021 Cash $351,000 Notes Receivable 72,000 Supplies & Inventory 81,000 Prepaid expense 31,500 Long-term investments 0 Machines and tools 166,500 Accumulated depreciation-equipment (63,000) Total Assets $639,000 Dec 31, 2020 $58,500 63,000 121,500 54,000 81,000 144,000 (45,000) $477,000 Liabilities & Stockholders' Equity Accounts payable $ 76,500 $ 31,500 Bonds payable (long-term) 166,500 211,500 Common Stock 180,000 103,500 Retained Earnings 216,000 130,500 Total Liabilities & Stockholders' Equity $639,000 $477,000 Income Statement Information (2021): 1. Net income for the year ending December 31, 2021 is $130,500. 2. Depreciation expense is $18,000. 3. There is a loss of $9,000 resulted from the sale of long-term investment. Additional information (2021): 1. All sales and purchases of inventory are on account (or credit). 2. Received cash for the sale of long-term investments that had a cost of $81,000, yielding a $9,000 loss. 3. Cash dividends paid is $45,000. 4. The company purchased new machines and tools for $22,500 cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts