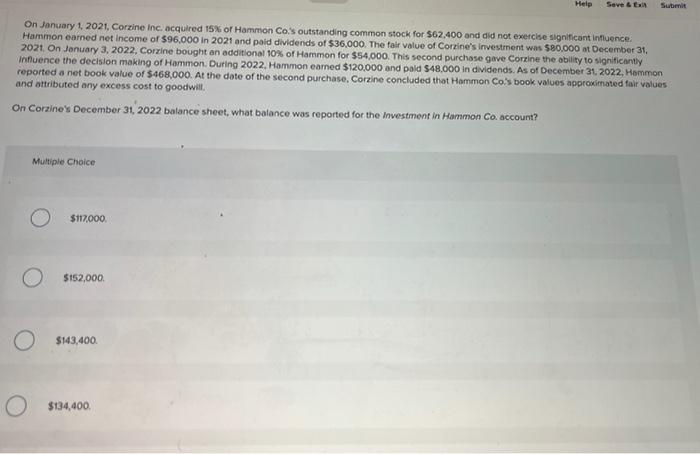

Question: Q.18 Help Save & E Submit On January 1, 2021. Corzine Inc. acquired 15% of Hammon Co.'s outstanding common stock for $62.400 and did not

Help Save & E Submit On January 1, 2021. Corzine Inc. acquired 15% of Hammon Co.'s outstanding common stock for $62.400 and did not exercise significant influence. Hammon earned net income of 596,000 in 2021 and paid dividends of $36,000. The fair value of Corzine's investment was $80.000 at December 31 2021. On January 3, 2022, Corzine bought an additional 10% of Hammon for $54,000. This second purchase gave Corzine the ability to significantly Influence the decision making of Hammon. During 2022, Hammon earned $120,000 and paid $48,000 in dividends. As of December 31, 2022, Hammon reported a netbook value of $468,000. At the date of the second purchase. Corzine concluded that Hammon Co's book values approximated fair values and attributed any excess cost to goodwill On Corzine's December 31, 2022 balance sheet, what balance was reported for the Investment in Hammon Co. account? Multiple Choice $117.000 $152,000 O $143,400 $134,400. Multiple Choice $117.000 $152.000. $143,400. $134,400 $141,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts