Question: q18. pls provide Complete solution. thankyou so much. Question 18 1 pts On June 1, 2020, a corporation purchased rights to amine totaling P12,300,000, of

q18. pls provide Complete solution. thankyou so much.

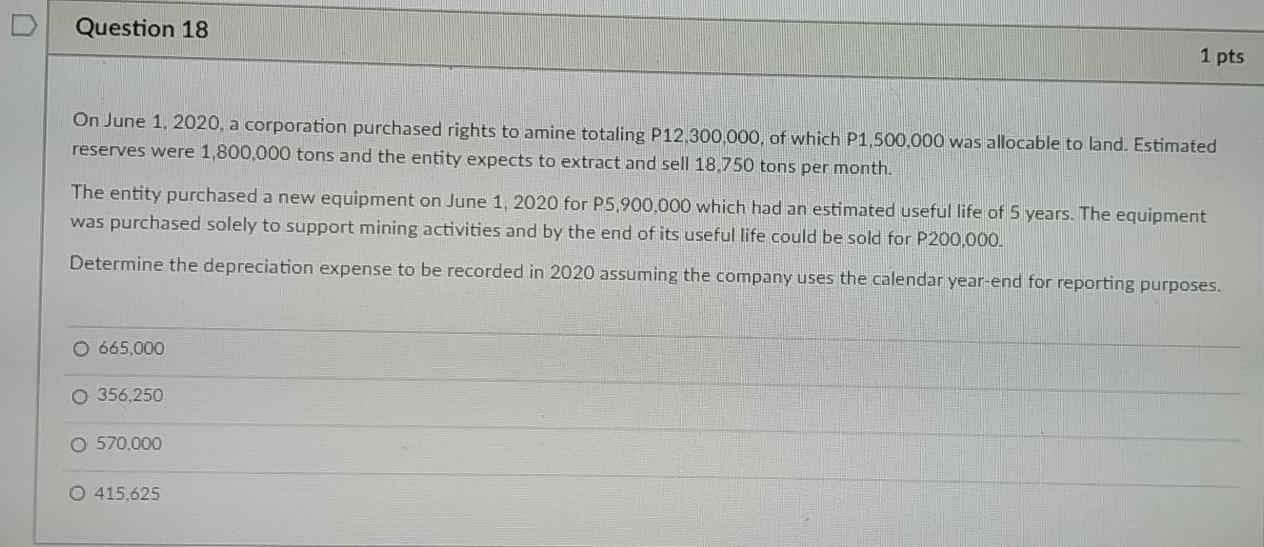

Question 18 1 pts On June 1, 2020, a corporation purchased rights to amine totaling P12,300,000, of which P1,500,000 was allocable to land. Estimated reserves were 1,800,000 tons and the entity expects to extract and sell 18,750 tons per month The entity purchased a new equipment on June 1, 2020 for P5,900,000 which had an estimated useful life of 5 years. The equipment was purchased solely to support mining activities and by the end of its useful life could be sold for P200,000. Determine the depreciation expense to be recorded in 2020 assuming the company uses the calendar year-end for reporting purposes. O 665,000 O 356,250 0 570.000 O 415,625

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts