Question: Q1a.? Q1b.? Section A: Taxation [Total marks - 25] Question 1 - Sole trading business Yasir, a sole trader, had the following results for year

Q1a.?

Q1b.? ![Q1a.? Q1b.? Section A: Taxation [Total marks - 25] Question 1](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66eb1844de0d9_20466eb18447821e.jpg)

![Q1a.? Q1b.? Section A: Taxation [Total marks - 25] Question 1](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66eb1844de0d9_20466eb18447821e.jpg)

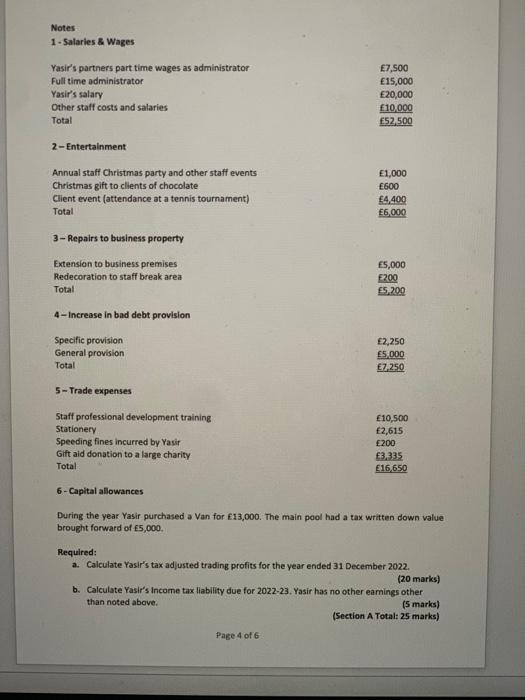

Section A: Taxation [Total marks - 25] Question 1 - Sole trading business Yasir, a sole trader, had the following results for year ended 31 December 2022: See over page for Notes. 6-Capital allowances During the year Yasir purchased a Van for 13,000. The main pool had a tax written down value brought forward of 5,000. Required: a. Calculate Yasir's tax adjusted trading profits for the year ended 31 December 2022. (20 marks) b. Calculate Yasir's income tax llability due for 2022-23. Yasir has no other eamings other than noted above. (5 marks) (Section A Total: 25 marks) Page 4 of 6

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock