Question: q1(c), (d) and (e) ANSWER QUESTION 1 1. Answer any three parts of the following question. All questions carry equal marks. Your answer for each

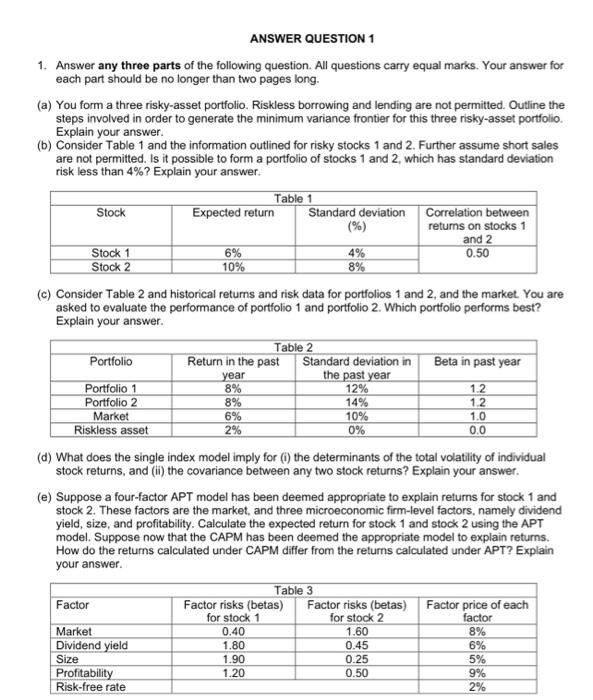

ANSWER QUESTION 1 1. Answer any three parts of the following question. All questions carry equal marks. Your answer for each part should be no longer than two pages long. (a) You form a three risky-asset portfolio. Riskless borrowing and lending are not permitted. Outline the steps involved in order to generate the minimum variance frontier for this three risky-asset portfolio. Explain your answer. (b) Consider Table 1 and the information outlined for risky stocks 1 and 2. Further assume short sales are not permitted. Is it possible to form a portfolio of stocks 1 and 2, which has standard deviation risk less than 4% ? Explain your answer. (c) Consider Table 2 and historical returns and risk data for portfolios 1 and 2 , and the market. You are asked to evaluate the performance of portfolio 1 and portfolio 2 . Which portfolio performs best? Explain your answer. (d) What does the single index model imply for (i) the determinants of the total volatility of individual stock returns, and (ii) the covariance between any two stock returns? Explain your answer. (e) Suppose a four-factor APT model has been deemed appropriate to explain returns for stock 1 and stock 2. These factors are the market, and three microeconomic firm-level factors, namely dividend yield, size, and profitability. Calculate the expected return for stock 1 and stock 2 using the APT model. Suppose now that the CAPM has been deemed the appropriate model to explain returns. How do the returns calculated under CAPM differ from the returns calculated under APT? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts