Question: Q1:Using published sources (for example, The Wall Street Journal, Barrons, Federal Reserve Bulletin), look up the exchange rate for U.S. dollars with Japanese yen for

Q1:Using published sources (for example, The Wall Street Journal, Barrons, Federal Reserve Bulletin), look up the exchange rate for U.S. dollars with Japanese yen for each of the past 10 years (you can use an average for the year or a specific time period each year). Based on these exchange rates, compute and discuss the yearly exchange rate effect on an investment in Japanese stocks by a U.S. investor (5 Marks). Discuss the impact of this exchange rate effect on the risk of Japanese stocks for a U.S. investor (5 Marks).

Solution Q1:

...................................................................................................

CLO 3 Maximum Marks 10

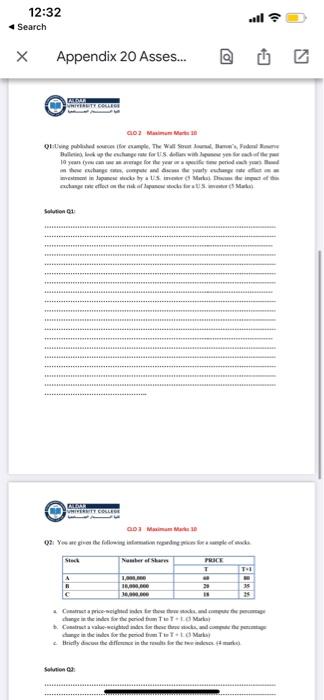

Q2: You are given the following information regarding prices for a sample of stocks.

Stock Number of Shares

A 1,000,000

B 10,000,000

C 30,000,000

PRICE

T T+1

60 80 20 35 18 25

a. Construct a price-weighted index for these three stocks, and compute the percentage change in the index for the period from T to T + 1. (3 Marks)

b. Construct a value-weighted index for these three stocks, and compute the percentage change in the index for the period from T to T + 1. (3 Marks)

c. Briefly discuss the difference in the results for the two indexes. (4 marks).

Solution Q2:

......................................................................................

CLO 4 Maximum Marks 10

Q3: The value of an asset is the present value of the expected returns from the asset during the holding period. An investment will provide a stream of returns during this period, and it is necessary to discount this stream of returns at an appropriate rate to determine the assets present value. A dividend valuation model such as the following is frequent.

where:

Pi = the current price of Common Stock i

D1 = the expected dividend in Period 1

ki = the required rate of return on Stock i

gi = the expected constant-growth rate of dividends for Stock i

A. Identify the three factors that must be estimated for any valuation model, and explain why these estimates are more difficult to derive for common stocks than for bonds (4 Marks).

B. Explain the principal problem involved in using a dividend valuation model to value (3 Marks):

(1) companies whose operations are closely correlated with economic cycles. (2) companies that are of very large and mature.

(3) companies that are quite small and are growing rapidly.

Solution

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock