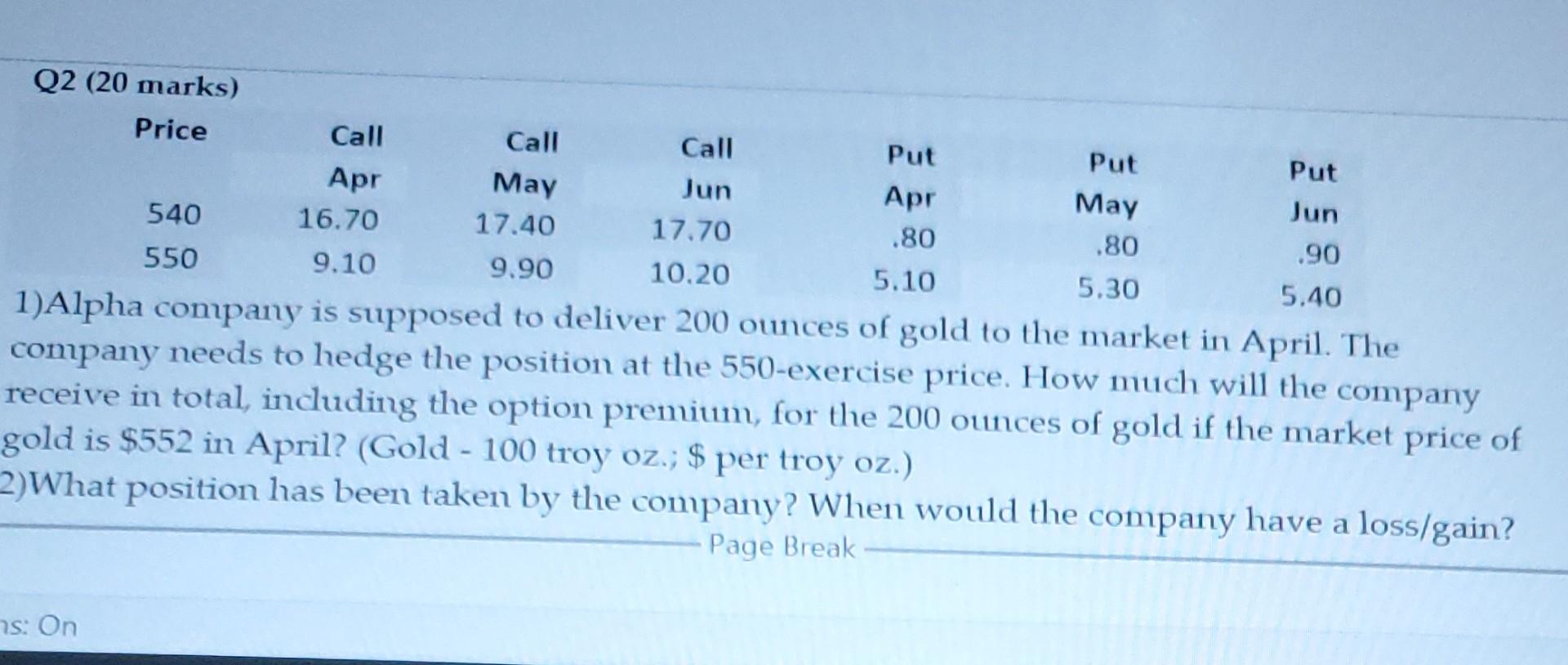

Question: Q2 (20 marks) Price Call Call Call Put Put Put Apr May Jun Apr May Jun 540 16.70 17.40 17.70 .80 .80 .90 550 9.10

Q2 (20 marks) Price Call Call Call Put Put Put Apr May Jun Apr May Jun 540 16.70 17.40 17.70 .80 .80 .90 550 9.10 9.90 10.20 5.10 5.30 5.40 1)Alpha company is supposed to deliver 200 ounces of gold to the market in April. The company needs to hedge the position at the 550-exercise price. How much will the company receive in total, including the option premium, for the 200 ounces of gold if the market price of gold is $552 in April? (Gold - 100 troy oz.; $ per troy oz.) 2)What position has been taken by the company? When would the company have a loss/gain? Page Break 7: On

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts