Question: Q2 (a) Jalse Corporation has two projects that it would like to undertake. However, due to financial constraints, the two projects, Project 1 and Project

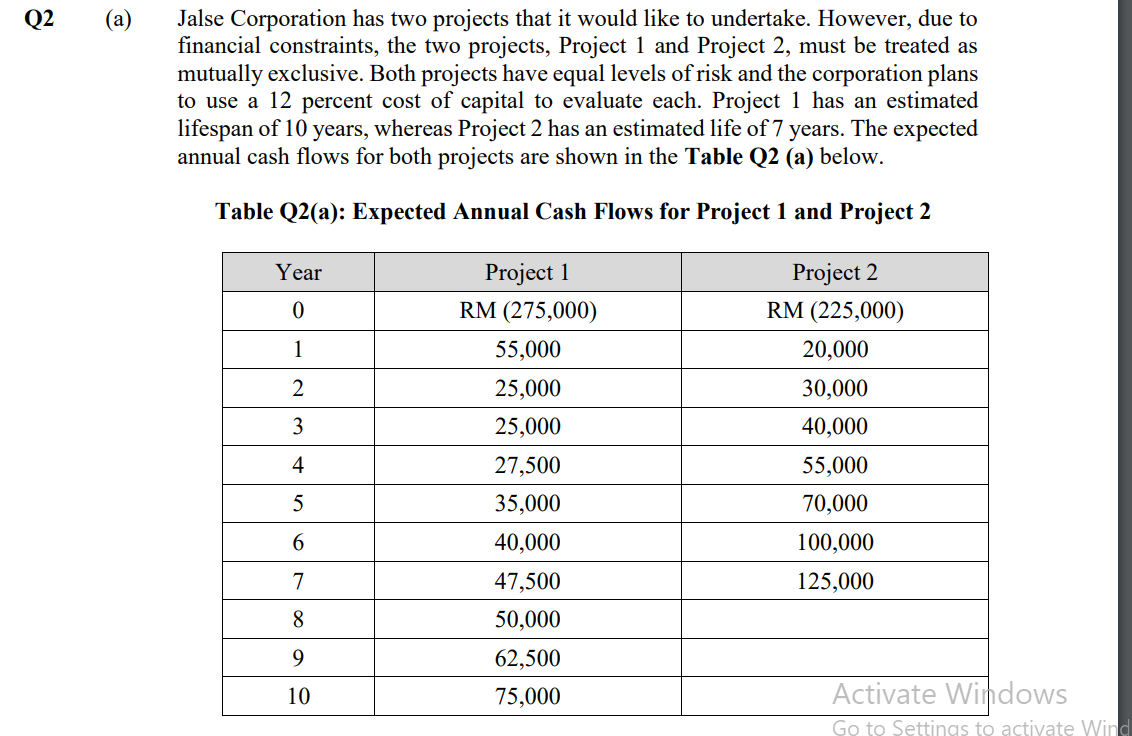

Q2 (a) Jalse Corporation has two projects that it would like to undertake. However, due to financial constraints, the two projects, Project 1 and Project 2, must be treated as mutually exclusive. Both projects have equal levels of risk and the corporation plans to use a 12 percent cost of capital to evaluate each. Project 1 has an estimated lifespan of 10 years, whereas Project 2 has an estimated life of 7 years. The expected annual cash flows for both projects are shown in the Table Q2 (a) below. Table Q2(a): Expected Annual Cash Flows for Project 1 and Project 2 Year 0 Project 1 RM (275,000) 55,000 Project 2 RM (225,000) 20,000 1 2 25,000 30,000 3 25,000 40,000 4 27,500 55,000 70,000 5 35,000 6 100,000 125,000 7 8 40,000 47,500 50,000 62,500 75,000 9 10 Activate Windows Go to Settings to activate Wind (i) Compute and interpret the Net Present Value (NPV) for each project. (7 marks) (ii) Compute and interpret the Internal Rate of Return (IRR) for each project. (11 marks) (iii) Compute the Profitability Index (PI) for each project. (4 marks) (iv) Explain which project should be accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts