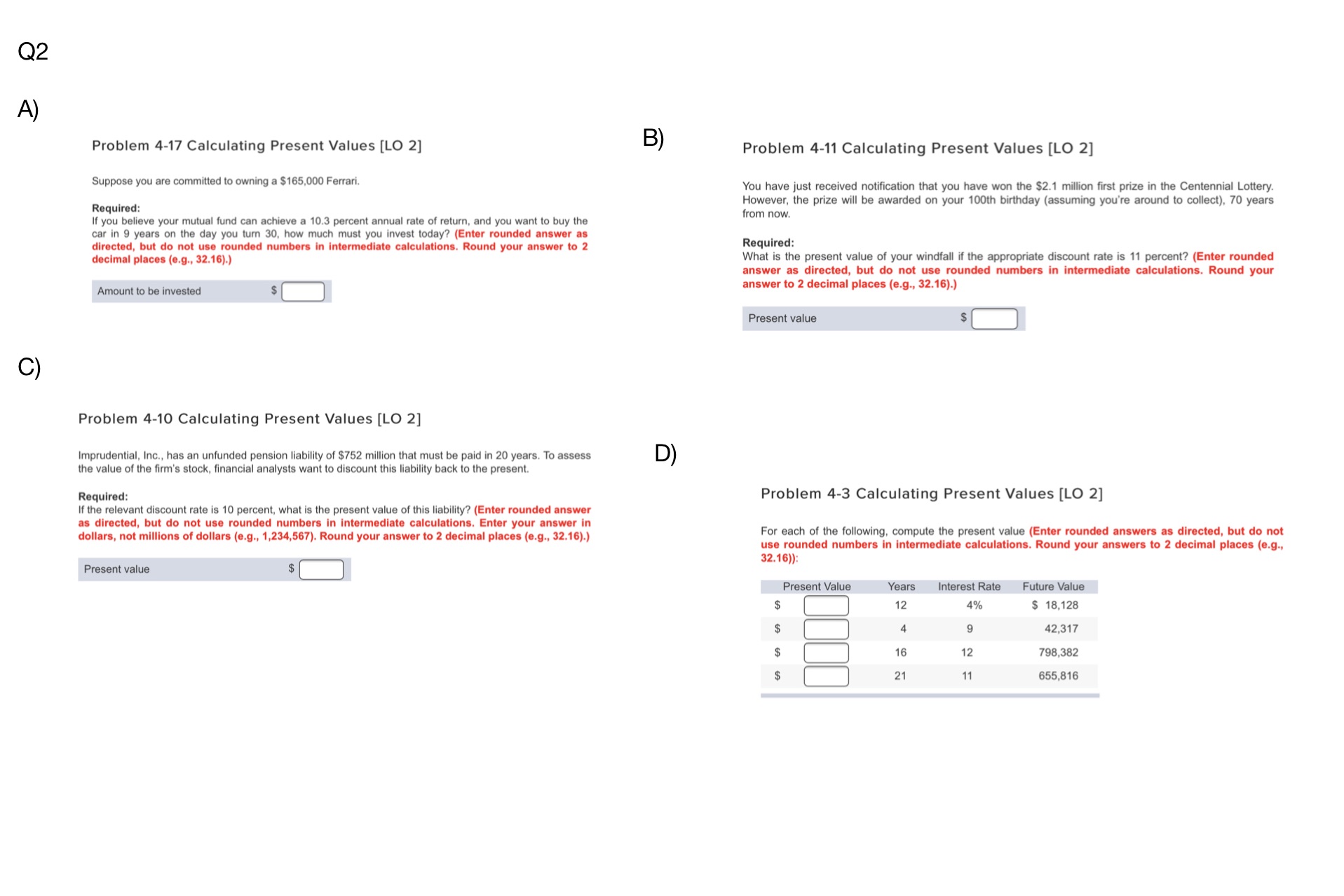

Question: Q2 A) Problem 4-17 Calculating Present Values [LO 2] B) Problem 4-11 Calculating Present Values [LO 2] Suppose you are committed to owning a $165,000

Q2 A) Problem 4-17 Calculating Present Values [LO 2] B) Problem 4-11 Calculating Present Values [LO 2] Suppose you are committed to owning a $165,000 Ferrari. You have just received notification that you have won the $2.1 million first prize in the Centennial Lottery. However, the prize will be awarded on your 100th birthday (assuming you're around to collect), 70 years Required: If you believe your mutual fund can achieve a 10.3 percent annual rate of return, and you want to buy the from now. car in 9 years on the day you turn 30, how much must you invest today? (Enter rounded answer as directed, but do not use rounded numbers in intermediate calculations. Round your answer to 2 Required: decimal places (e.g., 32.16).) What is the present value of your windfall if the appropriate discount rate is 11 percent? (Enter rounded answer as directed, but do not use rounded numbers in intermediate calculations. Round your Amount to be invested answer to 2 decimal places (e.g., 32.16).) Present value C) Problem 4-10 Calculating Present Values [LO 2] Imprudential, Inc., has an unfunded pension liability of $752 million that must be paid in 20 years. To assess D) the value of the firm's stock, financial analysts want to discount this liability back to the present. Required: Problem 4-3 Calculating Present Values [LO 2] If the relevant discount rate is 10 percent, what is the present value of this liability? (Enter rounded answer as directed, but do not use rounded numbers in intermediate calculations. Enter your answer in dollars, not millions of dollars (e.g., 1,234,567). Round your answer to 2 decimal places (e.g., 32.16).) For each of the following, compute the present value (Enter rounded answers as directed, but do not use rounded numbers in intermediate calculations. Round your answers to 2 decimal places (e.g., 32.16)): Present value Present Value Years Interest Rate Future Value 12 4% $ 18,128 42,317 16 12 798,382 21 11 655,816