Question: Q2. (a) Using CAPM, solve the following: What return does the CAPM predicts for an individual security that has a beta value of 0.5 when

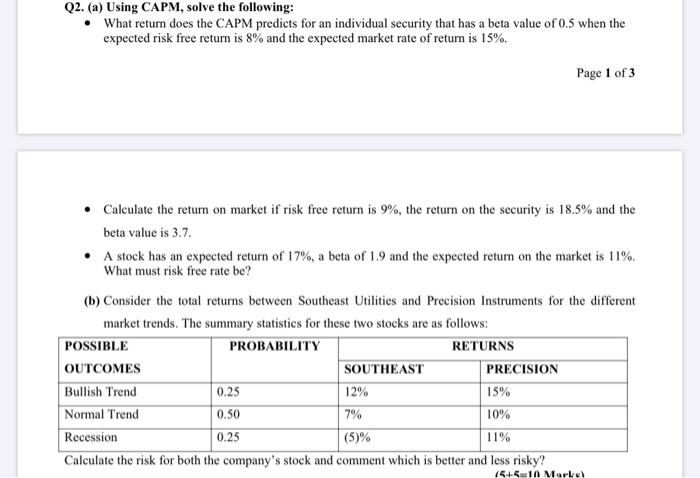

Q2. (a) Using CAPM, solve the following: What return does the CAPM predicts for an individual security that has a beta value of 0.5 when the expected risk free return is 8% and the expected market rate of return is 15%. Page 1 of 3 Calculate the return on market if risk free return is 9%, the return on the security is 18.5% and the beta value is 3.7. A stock has an expected return of 17%, a beta of 1.9 and the expected return on the market is 11%. What must risk free rate be? (b) Consider the total returns between Southeast Utilities and Precision Instruments for the different market trends. The summary statistics for these two stocks are as follows: POSSIBLE PROBABILITY RETURNS OUTCOMES SOUTHEAST PRECISION Bullish Trend 0.25 12% 15% Normal Trend 0.50 7% 10% Recession (5)% 11% Calculate the risk for both the company's stock and comment which is better and less risky? 0.25 154510 Merle

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts