Question: Q2. Based on Q1 (a) above, construct the ATCF if $40,000 is expected to be obtained annually from operating this equipment. a) Use the Corporate

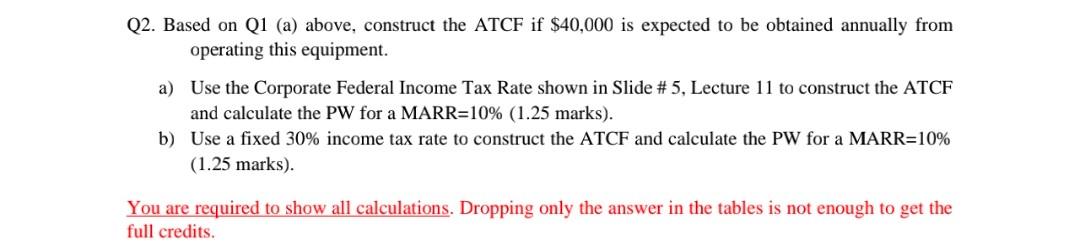

Q2. Based on Q1 (a) above, construct the ATCF if $40,000 is expected to be obtained annually from operating this equipment. a) Use the Corporate Federal Income Tax Rate shown in Slide # 5, Lecture 11 to construct the ATCF and calculate the PW for a MARR=10% (1.25 marks). b) Use a fixed 30% income tax rate to construct the ATCF and calculate the PW for a MARR=10% (1.25 marks). You are required to show all calculations. Dropping only the answer in the tables is not enough to get the full credits. Q2. Based on Q1 (a) above, construct the ATCF if $40,000 is expected to be obtained annually from operating this equipment. a) Use the Corporate Federal Income Tax Rate shown in Slide # 5, Lecture 11 to construct the ATCF and calculate the PW for a MARR=10% (1.25 marks). b) Use a fixed 30% income tax rate to construct the ATCF and calculate the PW for a MARR=10% (1.25 marks). You are required to show all calculations. Dropping only the answer in the tables is not enough to get the full credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts