Question: Q2 C. (20 Marks) a) What are the two common types of depreciation and why is it so important to tax calculation? Give an example

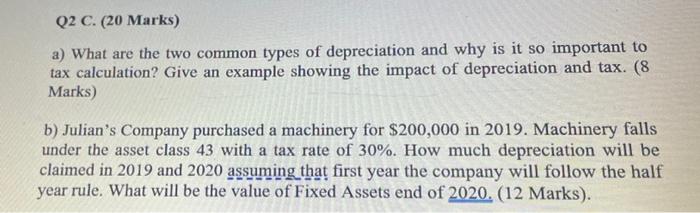

Q2 C. (20 Marks) a) What are the two common types of depreciation and why is it so important to tax calculation? Give an example showing the impact of depreciation and tax. (8 Marks) b) Julian's Company purchased a machinery for $200,000 in 2019. Machinery falls under the asset class 43 with a tax rate of 30%. How much depreciation will be claimed in 2019 and 2020 assuming that first year the company will follow the half year rule. What will be the value of Fixed Assets end of 2020. (12 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts