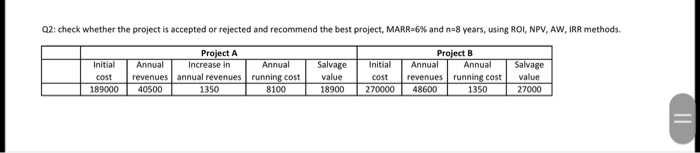

Question: Q2: check whether the project is accepted or rejected and recommend the best project, MARR=6% and n=8 years, using ROI, NPV, AW, IRR methods Salvage

Q2: check whether the project is accepted or rejected and recommend the best project, MARR=6% and n=8 years, using ROI, NPV, AW, IRR methods Salvage Initial cost 189000 Project A Annual Increase in Annual revenues annual revenues running cost 40500 1350 8100 Project B Annual Annual revenues running cost 48600 1350 Initial cost 270000 value Salvage value 27000 18900 Q2: check whether the project is accepted or rejected and recommend the best project, MARR=6% and n=8 years, using ROI, NPV, AW, IRR methods Salvage Initial cost 189000 Project A Annual Increase in Annual revenues annual revenues running cost 40500 1350 8100 Project B Annual Annual revenues running cost 48600 1350 Initial cost 270000 value Salvage value 27000 18900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts