Question: Q2 - Comprehensive Problem: You may use the working papers designed for Problem 2-1A or 2-2b in solving this problem. P2-2B Judi Dench is a

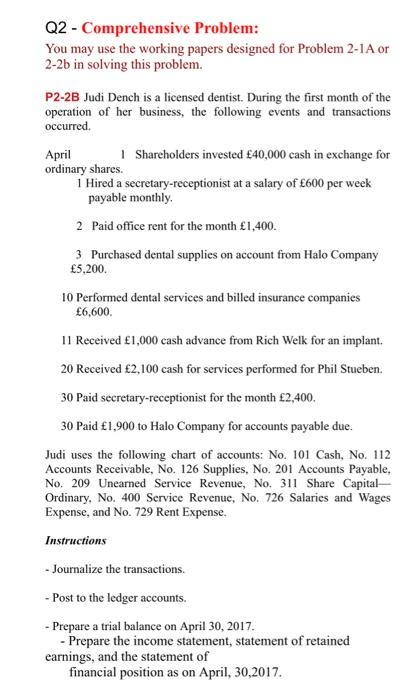

Q2 - Comprehensive Problem: You may use the working papers designed for Problem 2-1A or 2-2b in solving this problem. P2-2B Judi Dench is a licensed dentist. During the first month of the operation of her business, the following events and transactions occurred. April | Shareholders invested 40,000 cash in exchange for ordinary shares. 1 Hired a secretary-receptionist at a salary of 600 per week payable monthly 2 Paid office rent for the month 1,400. 3 Purchased dental supplies on account from Halo Company 5,200 10 Performed dental services and billed insurance companies 6,600. 11 Received 1,000 cash advance from Rich Welk for an implant. 20 Received 2,100 cash for services performed for Phil Stueben. 30 Paid secretary-receptionist for the month 2,400. 30 Paid 1,900 to Halo Company for accounts payable due. Judi uses the following chart of accounts: No. 101 Cash, No. 112 Accounts Receivable, No. 126 Supplies, No. 201 Accounts Payable, No. 209 Unearned Service Revenue, No. 311 Share Capital Ordinary, No. 400 Service Revenue, No. 726 Salaries and Wages Expense, and No. 729 Rent Expense. Instructions - Journalize the transactions - Post to the ledger accounts. - Prepare a trial balance on April 30, 2017. - Prepare the income statement, statement of retained earnings, and the statement of financial position as on April, 30,2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts