Question: Q2. Consider a two period Binomial Model. If the Current Stock Price is 50$ and the risk-free rate is 4 %. For each period the

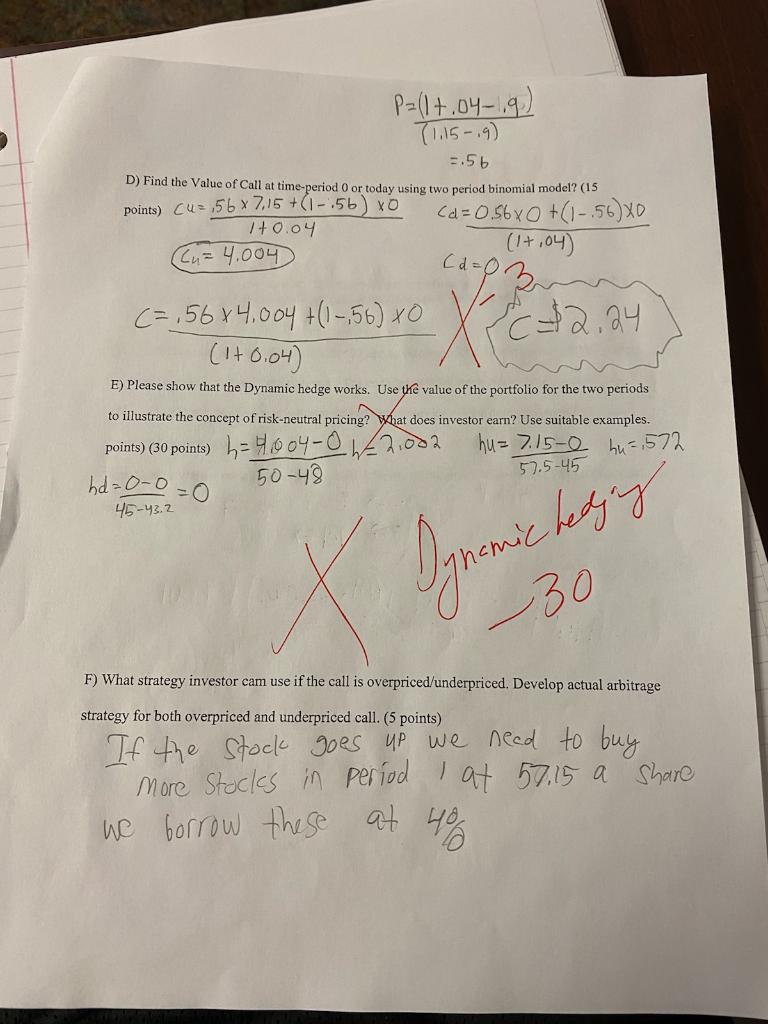

Q2. Consider a two period Binomial Model. If the Current Stock Price is 50$ and the risk-free rate is 4 %. For each period the stock can up by 15% and Down by 10%. The exercise price of this call option is 48$

P=(1+.04-19) 11.15-,9) =.56 D) Find the Value of Call at time-period o or today using two period binomial model? (15 points) Cu-,56 x 715 +(1-,5b) XO (a=0.560 + (1-5600 +0.04 Cu= 4.004 (d=1 03 (=56x4.004+ (1 -156) XO $2.94 (1+.04) Xpca (1+0.04 E) Please show that the Dynamic hedge works. Use the value of the portfolio for the two periods to illustrate the concept of risk-neutral pricing? What does investor earn? Use suitable examples. points) (30 points) h-4004-0122.002 hu= 7.15-0 hu = 1572 50-48 57.5-45 45-43.2 hd=0-0 =0 X Ogranic keting 30 F) What strategy investor cam use if the call is overpriced/underpriced. Develop actual arbitrage strategy for both overpriced and underpriced call. (5 points) If the stock goes up we need to buy more Stacks in period I at 57,15 a Share we borrow these at 4%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts