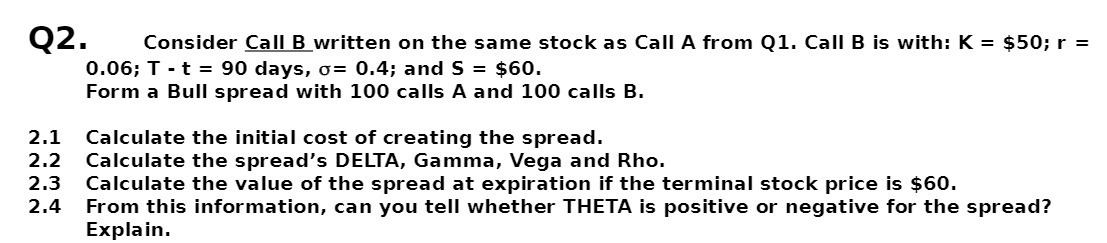

Question: Q2. Consider Call B written on the same stock as Call A from Q1. Call B is with: K = $50; r = 0.06: T

Q2. Consider Call B written on the same stock as Call A from Q1. Call B is with: K = $50; r = 0.06: T - t = 90 days. 0: 0.4: and S = $60. Form a Bull spread with 100 calls A and 100 calls B. Calculate the initial cost of creating the spread. Calculate the spread's DELTA. Gamma. Vega and Rho. Calculate the value of the spread at expiration if the terminal stock price is $60. From this information, can you tell whether THETA is positive or negative for the spread? Explain. UNION IFIWNH

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts