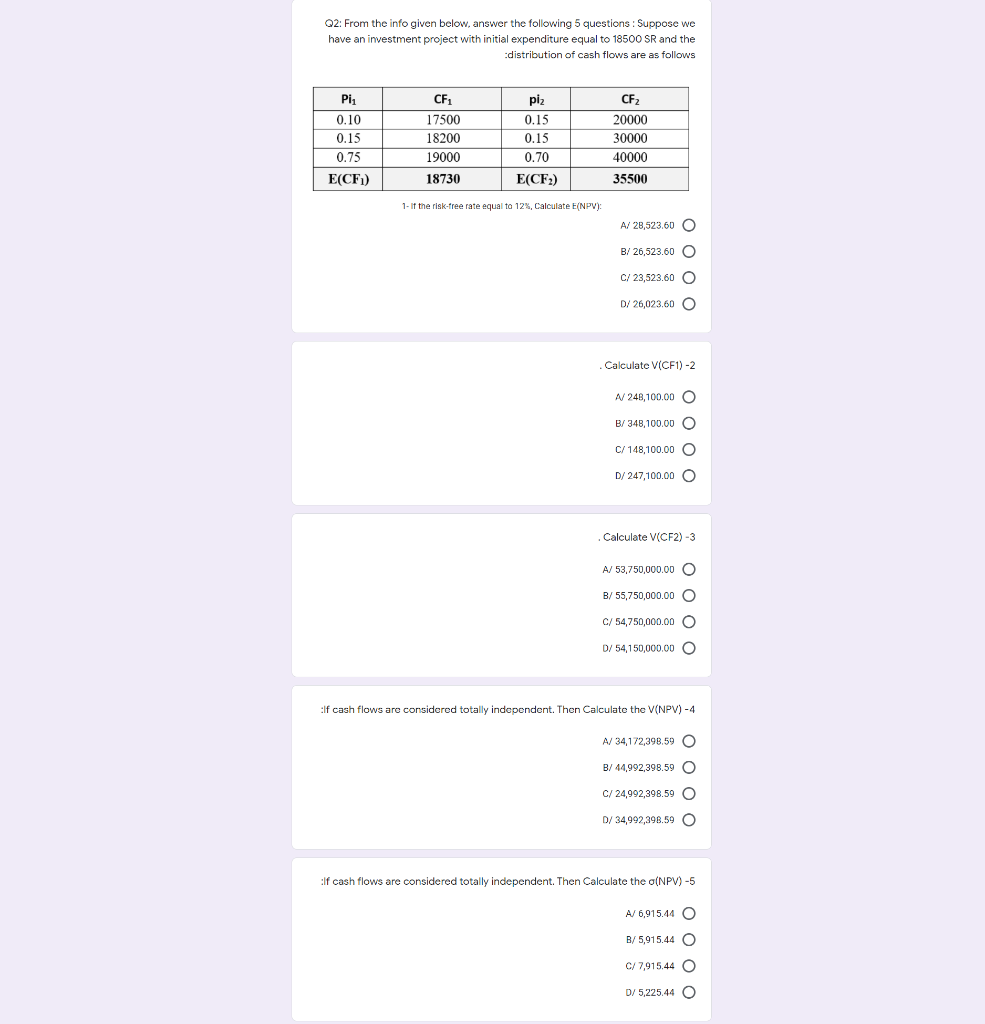

Question: Q2: From the info given below, answer the following 5 questions : Suppose we have an investment project with initial expenditure equal to 18500 SR

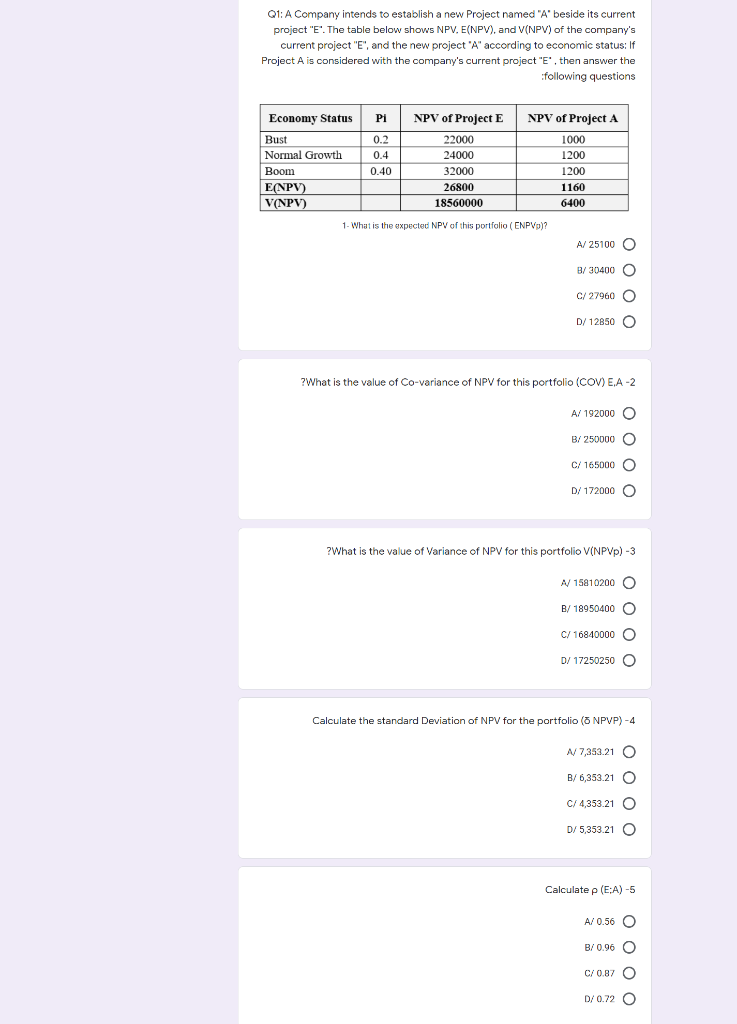

Q2: From the info given below, answer the following 5 questions : Suppose we have an investment project with initial expenditure equal to 18500 SR and the distribution of cash flows are as follows PI 0.10 0.15 0.75 E(CF1) CF 17500 18200 19000 18730E piz 0.15 0.15 0.70 (CF) CF2 20000 30000 40000 35500 1. If the risk-free rate equal to 12%, Calculate (NPV); A/ 28,523.60 O B/ 26,523.60 O C/23,523.60 O D/ 26,023.60 O Calculate (CF1)-2 A 248,100.00 O B/ 348,100.00 O C/148,100.00 O D/247,100.00 O Calculate V(CF2)-3 A/53,750,000.00 O B/ 55,750,000.00 O C/54,750,000.00 O D/54,150,000.00 O :If cash flows are considered totally independent. Then Calculate the V(NPV) -4 A/34,172,398.59 O B/ 44,992,398.59 O C/24,992,398.59 O D/34,992,398.59 O :If cash flows are considered totally independent. Then Calculate the (NPV) -5 A/6,915.44 O B/5,915.44 O C/7,915.44 O D/5,225.44 O Q1: A Company intends to establish a new Project named "A beside its current project "E". The table below shows NPV.E(NPV), and V(NPV) of the company's current project "E", and the new project 'A' according to economic status: If Project A is considered with the company's current project "E', then answer the following questions Economy Status P Bust Normal Growth Boom E(NPV) V(NPV) 0.2 0.4 0.40 NPV of Project E 22000 24000 32000 26800 18560000 NPV of Project A 1000 1200 1200 1160 6400 1- What is the expected NPV of this portfolio (ENPV)? A/25100 O B/ 30400 O C/ 27960 O D/12850 O ?What is the value of Co-variance of NPV for this portfolio (COV) EA-2 A/ 192000 O B/ 250000 O C/ 165000 O D/ 172000 O ? What is the value of Variance of NPV for this portfolio V(NPVp) - 3 AM 1581 0200 0 B/ 18950400 O C/ 16840000 O DI 17250250 O Calculate the standard Deviation of NPV for the portfolio ( NPVP)-4 AM 7,353.21 0 B/6,353.21 O OOOO C/ 4,353.21 O D/5,353 21 O Calculate p (EA)-5 OOOO D/0.72 O Q2: From the info given below, answer the following 5 questions : Suppose we have an investment project with initial expenditure equal to 18500 SR and the distribution of cash flows are as follows PI 0.10 0.15 0.75 E(CF1) CF 17500 18200 19000 18730E piz 0.15 0.15 0.70 (CF) CF2 20000 30000 40000 35500 1. If the risk-free rate equal to 12%, Calculate (NPV); A/ 28,523.60 O B/ 26,523.60 O C/23,523.60 O D/ 26,023.60 O Calculate (CF1)-2 A 248,100.00 O B/ 348,100.00 O C/148,100.00 O D/247,100.00 O Calculate V(CF2)-3 A/53,750,000.00 O B/ 55,750,000.00 O C/54,750,000.00 O D/54,150,000.00 O :If cash flows are considered totally independent. Then Calculate the V(NPV) -4 A/34,172,398.59 O B/ 44,992,398.59 O C/24,992,398.59 O D/34,992,398.59 O :If cash flows are considered totally independent. Then Calculate the (NPV) -5 A/6,915.44 O B/5,915.44 O C/7,915.44 O D/5,225.44 O Q1: A Company intends to establish a new Project named "A beside its current project "E". The table below shows NPV.E(NPV), and V(NPV) of the company's current project "E", and the new project 'A' according to economic status: If Project A is considered with the company's current project "E', then answer the following questions Economy Status P Bust Normal Growth Boom E(NPV) V(NPV) 0.2 0.4 0.40 NPV of Project E 22000 24000 32000 26800 18560000 NPV of Project A 1000 1200 1200 1160 6400 1- What is the expected NPV of this portfolio (ENPV)? A/25100 O B/ 30400 O C/ 27960 O D/12850 O ?What is the value of Co-variance of NPV for this portfolio (COV) EA-2 A/ 192000 O B/ 250000 O C/ 165000 O D/ 172000 O ? What is the value of Variance of NPV for this portfolio V(NPVp) - 3 AM 1581 0200 0 B/ 18950400 O C/ 16840000 O DI 17250250 O Calculate the standard Deviation of NPV for the portfolio ( NPVP)-4 AM 7,353.21 0 B/6,353.21 O OOOO C/ 4,353.21 O D/5,353 21 O Calculate p (EA)-5 OOOO D/0.72 O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts