Question: Q2.) Numeric Problem - Multiple IRRS Koza Madencilik starts developing a new mine with $8 million construction cost. In one year, mine will generate $30

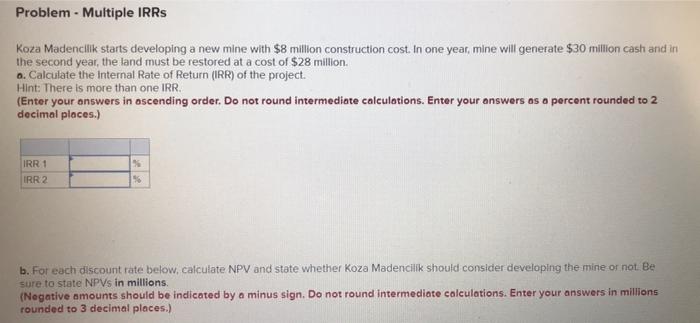

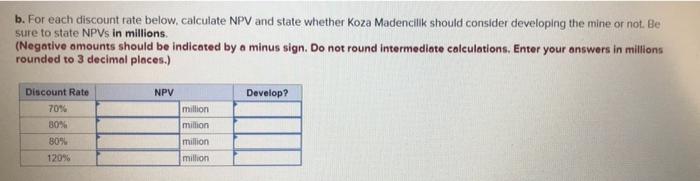

Problem - Multiple IRRS Koza Madencilik starts developing a new mine with $8 million construction cost. In one year, mine will generate $30 million cash and in the second year, the land must be restored at a cost of $28 million o. Calculate the Internal Rate of Return (IRR) of the project. Hint: There is more than one IRR. (Enter your answers in ascending order. Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) IRR 1 IRR2 16 b. For each discount rate below, calculate NPV and state whether Koza Madencilik should consider developing the mine or not. Be sure to state NPVs in millions (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers in millions rounded to 3 decimal places.) b. For each discount rate below.calculate NPV and state whether Koza Madencilik should consider developing the mine or not. Be sure to state NPVs in millions (Negative omounts should be indicated by a minus sign. Do not round intermediate calculations, Enter your answers in millions rounded to 3 decimal places.) NPV Develop ? Discount Rate 70% 80% 80% 120% million million million million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts