Question: Q2 (Performance Evaluation) Fill in the blank rows in the table below for (a) Average excess return, defined as portfolio return in excess of risk-free

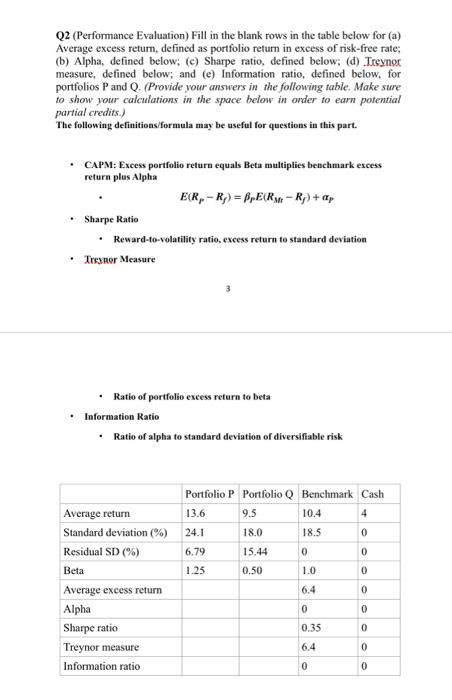

Q2 (Performance Evaluation) Fill in the blank rows in the table below for (a) Average excess return, defined as portfolio return in excess of risk-free rate; (b) Alpha, defined below; (c) Sharpe ratio, defined below; (d) Treynor measure, defined below; and (e) Information ratio, defined below, for portfolios P and Q. (Provide your answers in the following table. Make sure to show your calculations in the space below in onder to earn potential partial credits.) The following definitions/formula may be useful for questions in this part. - CAPM: Excess portfolio return equals Beta multiplies benchmark excess return plas Alpha E(RPRf)=FE(RMtRf)+P - Sharpe Ratio - Reward-to-volatility ratio, excess return to standard deviation - Tresuor Measure 3 - Ratio of portfolio excess return to beta - Information Ratio - Ratio of alpha to standard deviation of diversifiable risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts