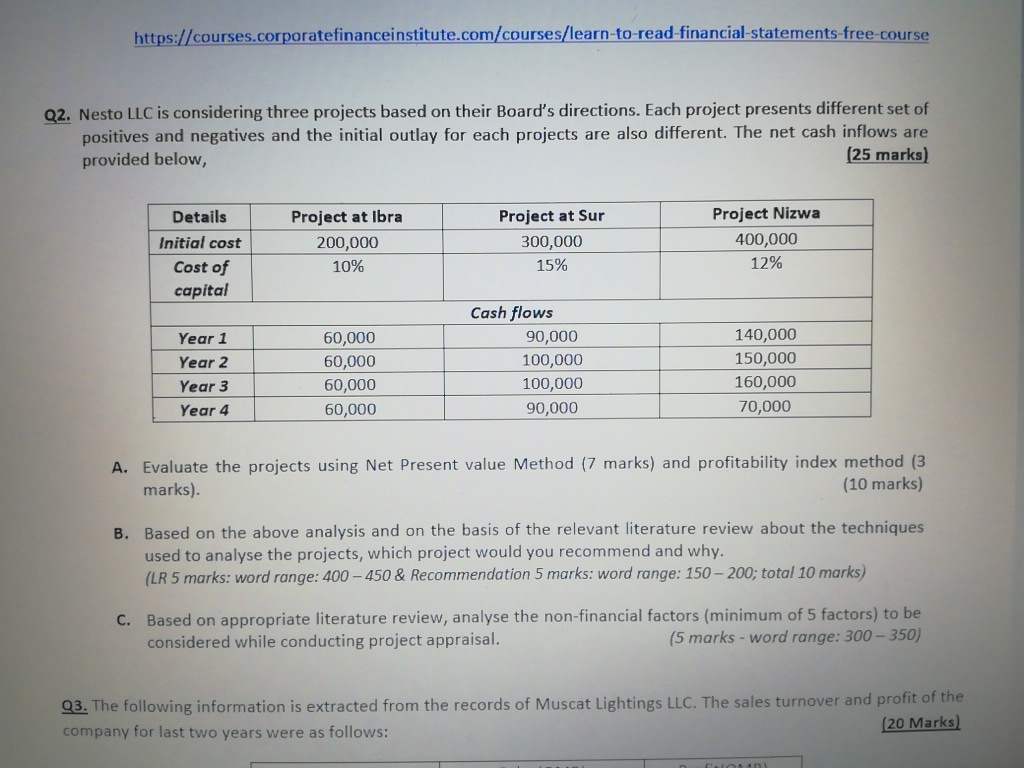

Question: Q2.. Please i need An answer for this question https://courses.corporatefinanceinstitute.com/courses/learn-to-read-financial statements-free course Q2. Nesto LLC is considering three projects based on their Board's directions. Each

Q2.. Please i need An answer for this question

https://courses.corporatefinanceinstitute.com/courses/learn-to-read-financial statements-free course Q2. Nesto LLC is considering three projects based on their Board's directions. Each project presents different set of positives and negatives and the initial outlay for each projects are also different. The net cash inflows are provided below, (25 marks) Details Initial cost Cost of capital Project at Ibra 200,000 10% Project at Sur 300,000 15% Project Nizwa 400,000 12% Year 1 Year 2 Year 3 Year 4 60,000 60,000 60,000 60,000 Cash flows 90,000 100,000 100,000 90,000 140,000 150,000 160,000 70,000 A. Evaluate the projects using Net Present value Method (7 marks) and profitability index method (3 marks). (10 marks) B. Based on the above analysis and on the basis of the relevant literature review about the techniques used to analyse the projects, which project would you recommend and why. (LR 5 marks: word range: 400-450 & Recommendation 5 marks: word range: 150 - 200; total 10 marks) C. Based on appropriate literature review, analyse the non-financial factors (minimum of 5 factors) to be considered while conducting project appraisal. (5 marks - word range: 300 - 350) 93. The following information is extracted from the records of Muscat Lightings LLC. The sales turnover and profit of the company for last two years were as follows: (20 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts