Question: Q2 Problem Solving (10 marks) Lee, Braun and James Company pays a 11 percent coupon rate on debentures due in 25 years. The current yield

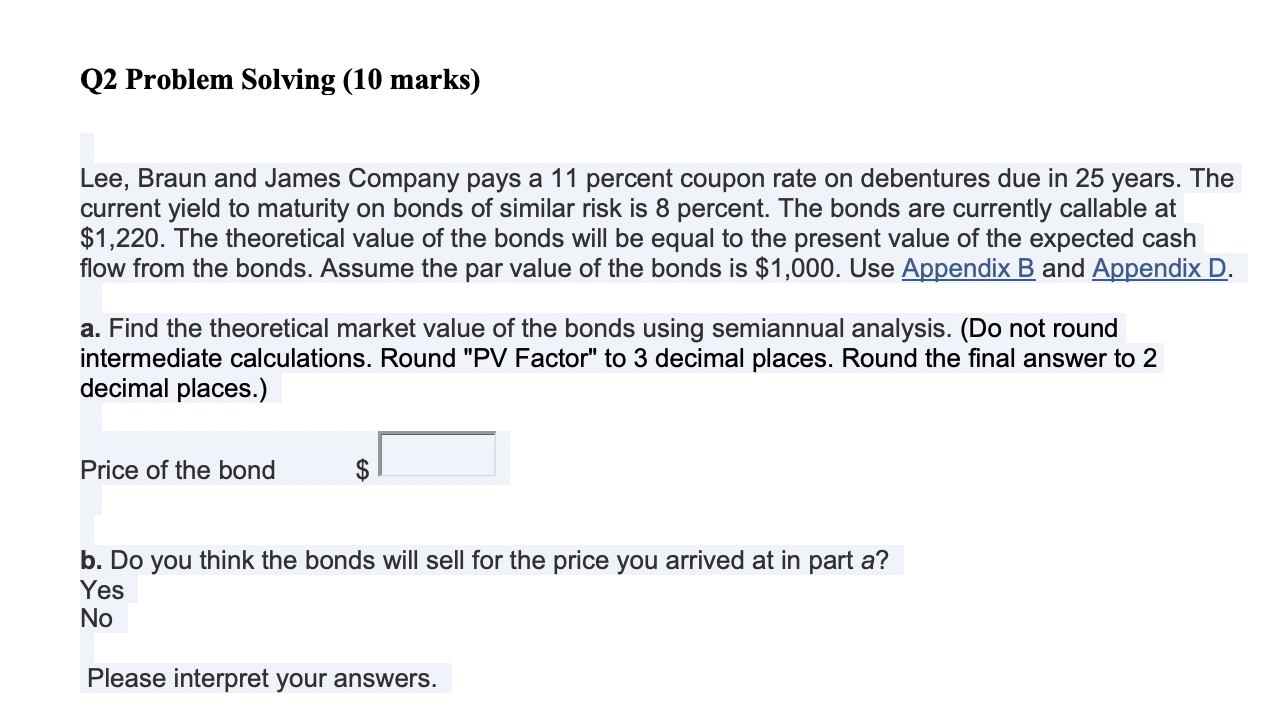

Q2 Problem Solving (10 marks) Lee, Braun and James Company pays a 11 percent coupon rate on debentures due in 25 years. The current yield to maturity on bonds of similar risk is 8 percent. The bonds are currently callable at $1,220. The theoretical value of the bonds will be equal to the present value of the expected cash flow from the bonds. Assume the par value of the bonds is $1,000. Use Appendix B and Appendix D. a. Find the theoretical market value of the bonds using semiannual analysis. (Do not round intermediate calculations. Round "PV Factor" to 3 decimal places. Round the final answer to 2 decimal places.) Price of the bond b. Do you think the bonds will sell for the price you arrived at in part a? Yes No Please interpret your answers. Q2 Problem Solving (10 marks) Lee, Braun and James Company pays a 11 percent coupon rate on debentures due in 25 years. The current yield to maturity on bonds of similar risk is 8 percent. The bonds are currently callable at $1,220. The theoretical value of the bonds will be equal to the present value of the expected cash flow from the bonds. Assume the par value of the bonds is $1,000. Use Appendix B and Appendix D. a. Find the theoretical market value of the bonds using semiannual analysis. (Do not round intermediate calculations. Round "PV Factor" to 3 decimal places. Round the final answer to 2 decimal places.) Price of the bond b. Do you think the bonds will sell for the price you arrived at in part a? Yes No Please interpret your answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts