Question: Q2 refernence Q2 answers Question 3: (5 marks) Using the financial statement data provided in QUESTION 2 earlier, fill in the blanks in the table

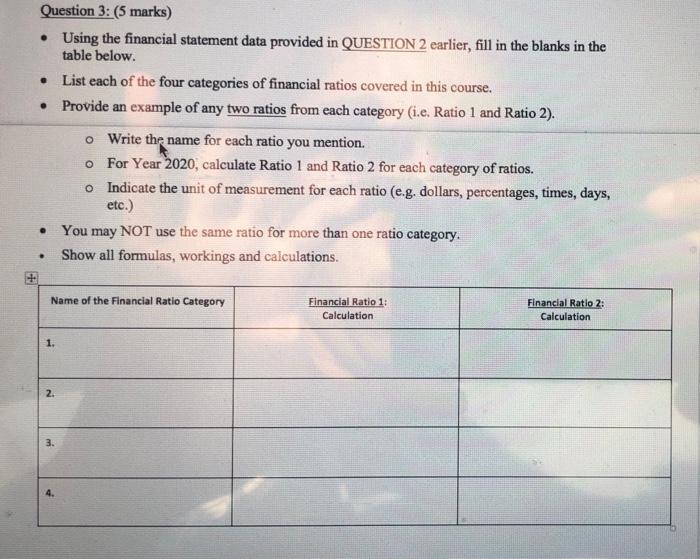

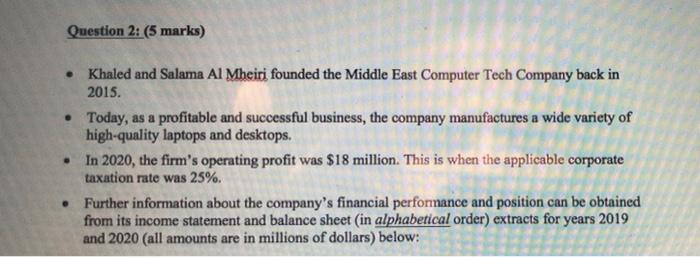

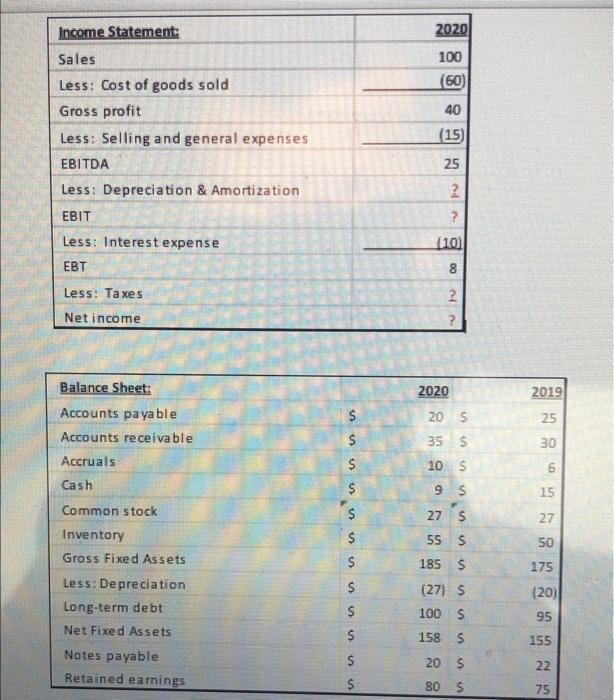

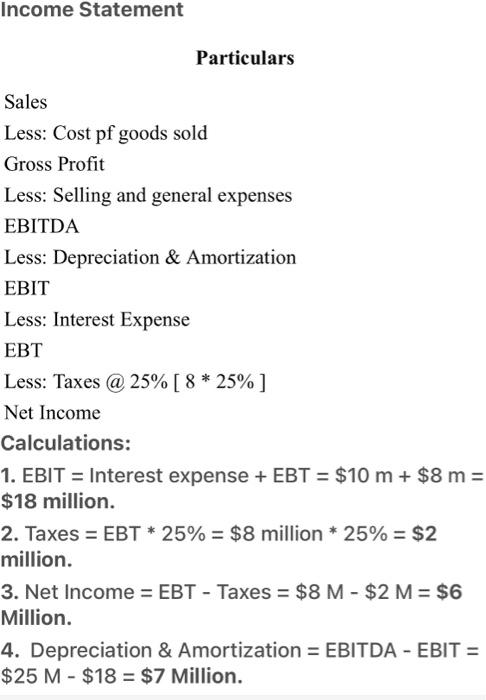

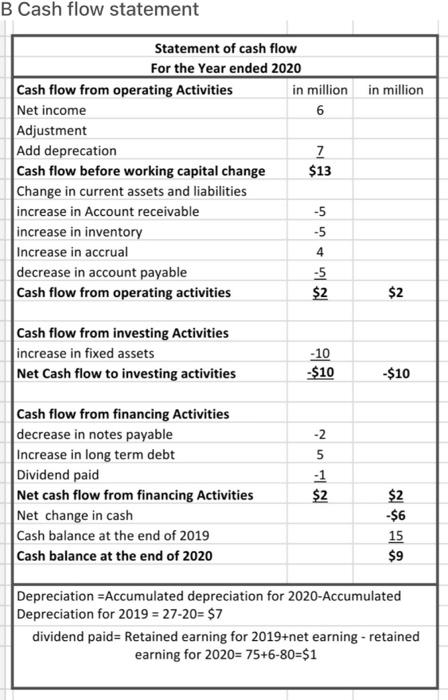

Question 3: (5 marks) Using the financial statement data provided in QUESTION 2 earlier, fill in the blanks in the table below. List each of the four categories of financial ratios covered in this course. Provide an example of any two ratios from each category (i.e. Ratio 1 and Ratio 2). o Write the name for each ratio you mention. o For Year 2020, calculate Ratio 1 and Ratio 2 for each category of ratios. o Indicate the unit of measurement for each ratio (e.g. dollars, percentages, times, days, etc.) You may NOT use the same ratio for more than one ratio category. Show all formulas, workings and calculations. . Name of the Financial Ratio Category Financial Ratio 1: Calculation Financial Ratlo 2: Calculation 1. 2. 4. Question 2: (5 marks) Khaled and Salama Al Mheiri founded the Middle East Computer Tech Company back in 2015. . Today, as a profitable and successful business, the company manufactures a wide variety of high-quality laptops and desktops. In 2020, the firm's operating profit was $18 million. This is when the applicable corporate taxation rate was 25%. Further information about the company's financial performance and position can be obtained from its income statement and balance sheet (in alphabetical order) extracts for years 2019 and 2020 (all amounts are in millions of dollars) below: . 2020 100 (60) 8 18 40 (15) Income Statement: Sales Less: Cost of goods sold Gross profit Less: Selling and general expenses EBITDA Less: Depreciation & Amortization EBIT Less: Interest expense EBT 25 2 ? (10) 8 2 Less: Taxes Net income 2020 2019 $ 20 S 25 Balance Sheet: Accounts payable Accounts receivable Accruals Cash $ 35 S 10 S . 30 $ 6 S 9 $ 15 Common stock $ 27 S 27 $ 55 S SO $ 185 $ 175 $ (27) S Inventory Gross Fixed Assets Less: Depreciation Long-term debt Net Fixed Assets Notes payable Retained earnings (20) 95 un 100 S 1585 S 155 S 22 20 S 80 $ S 75 Income Statement Particulars Sales Less: Cost pf goods sold Gross Profit Less: Selling and general expenses EBITDA Less: Depreciation & Amortization EBIT Less: Interest Expense Less: Taxes @ 25% [8 * 25% ] Net Income Calculations: 1. EBIT = Interest expense + EBT = $10 m + $8 m = $18 million. 2. Taxes = EBT * 25% = $8 million * 25% = $2 million. 3. Net Income = EBT - Taxes = $8 M - $2 M = $6 Million. 4. Depreciation & Amortization = EBITDA - EBIT = $25 M - $18 = $7 Million. B Cash flow statement in million Statement of cash flow For the Year ended 2020 Cash flow from operating Activities in million Net income 6 Adjustment Add deprecation 7 Cash flow before working capital change $13 Change in current assets and liabilities increase in Account receivable increase in inventory Increase in accrual decrease in account payable -5 Cash flow from operating activities $2 554 1 $2 Cash flow from investing Activities increase in fixed assets Net Cash flow to investing activities - 10 $10 -$10 Cash flow from financing Activities decrease in notes payable Increase in long term debt Dividend paid Net cash flow from financing Activities Net change in cash Cash balance at the end of 2019 Cash balance at the end of 2020 -2 5 -1 $2 $2 $6 15 $9 Depreciation Accumulated depreciation for 2020-Accumulated Depreciation for 2019 = 27-20= $7 dividend paid= Retained earning for 2019+net earning - retained earning for 2020= 75+6-80=$1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts