Question: Q2) SFM Ltd. is evaluating a project which will result into Initial Outlay of Rs.40 Crores. The life of project is expected to be

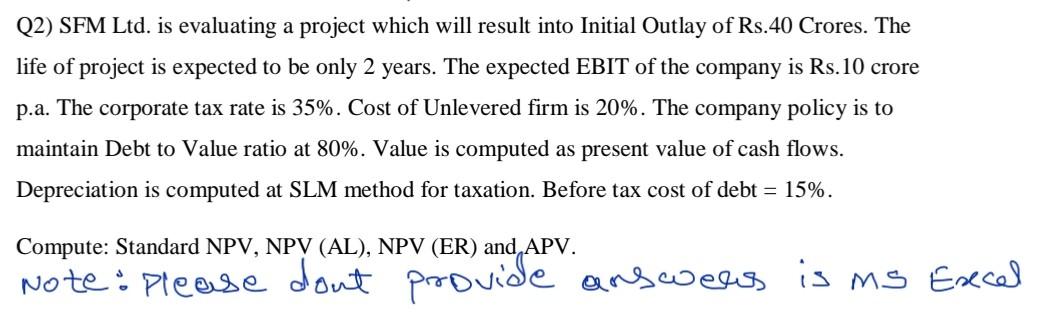

Q2) SFM Ltd. is evaluating a project which will result into Initial Outlay of Rs.40 Crores. The life of project is expected to be only 2 years. The expected EBIT of the company is Rs.10 crore p.a. The corporate tax rate is 35%. Cost of Unlevered firm is 20%. The company policy is to maintain Debt to Value ratio at 80%. Value is computed as present value of cash flows. Depreciation is computed at SLM method for taxation. Before tax cost of debt = 15%. Compute: Standard NPV, NPV (AL), NPV (ER) and APV. Note: Please don't provide answers is Ms Excel

Step by Step Solution

3.39 Rating (146 Votes )

There are 3 Steps involved in it

To calculate the various NPV and APV values for the project we need to first calculate the projects cash flows The initial outlay is Rs 40 crores For each year the EBIT will be Rs 10 crores and the de... View full answer

Get step-by-step solutions from verified subject matter experts