Question: q2 Should your company replace its year-old machine? A. No, because there is a loss from replacing the machine. B. Yes, because there is a

q2 Should your company replace its year-old machine?

A.

No,

because there is a

loss

from replacing the machine.

B.

Yes,

because there is a

profit

from replacing the machine.

C.

Yes, because a new machine will always be an improvement for the company.

D.

No, because the only time a machine should be replaced is when it stops working completely.

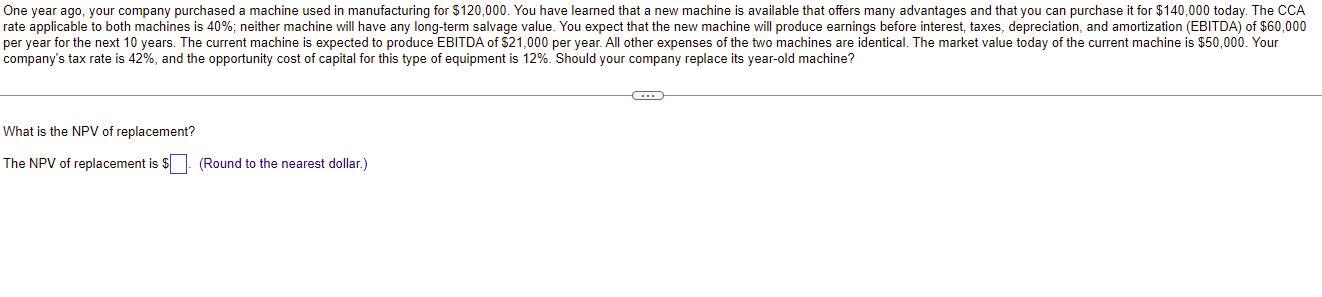

One year ago, your company purchased a machine used in manufacturing for $120,000. You have learned that a new machine is available that offers many advantages and that you can purchase it for $140,000 today. The CCA rate applicable to both machines is 40%; neither machine will have any long-term salvage value. You expect that the new machine will produce earnings before interest, taxes, depreciation, and amortization (EBITDA) of $60,000 per year for the next 10 years. The current machine is expected to produce EBITDA of $21,000 per year. All other expenses of the two machines are identical. The market value today of the current machine is $50,000. Your company's tax rate is 42%, and the opportunity cost of capital for this type of equipment is 12%. Should your company replace its year-old machine? What is the NPV of replacement? The NPV of replacement is $ (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts