Question: Q2: Sonic has the following information: Income statement method used to estimate un-collectible accounts. Company bases estimate on CREDIT sales ONLY. Cash sales =$1,540,123 Credit

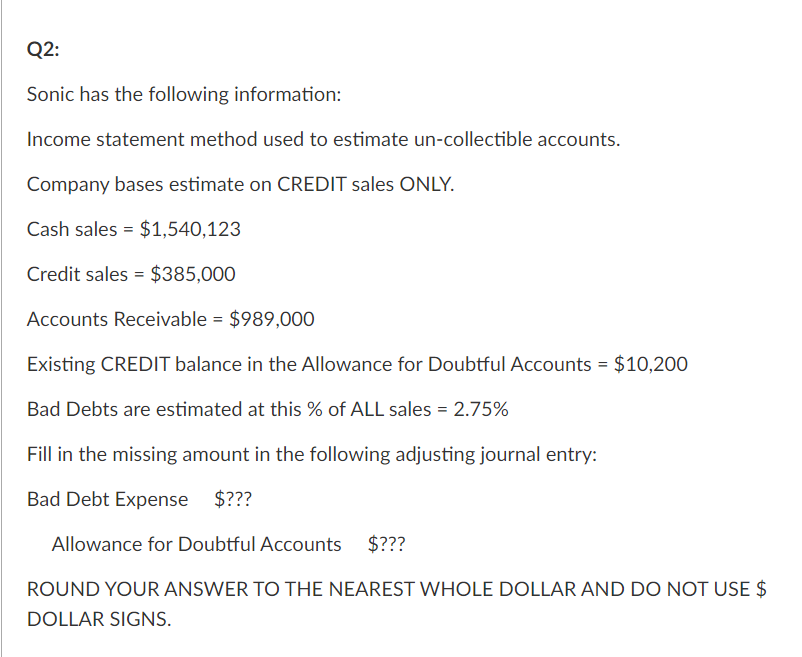

Q2: Sonic has the following information: Income statement method used to estimate un-collectible accounts. Company bases estimate on CREDIT sales ONLY. Cash sales =$1,540,123 Credit sales =$385,000 Accounts Receivable =$989,000 Existing CREDIT balance in the Allowance for Doubtful Accounts =$10,200 Bad Debts are estimated at this % of ALL sales =2.75% Fill in the missing amount in the following adjusting journal entry: Bad Debt Expense $??? Allowance for Doubtful Accounts \$??? ROUND YOUR ANSWER TO THE NEAREST WHOLE DOLLAR AND DO NOT USE DOLLAR SIGNS

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock