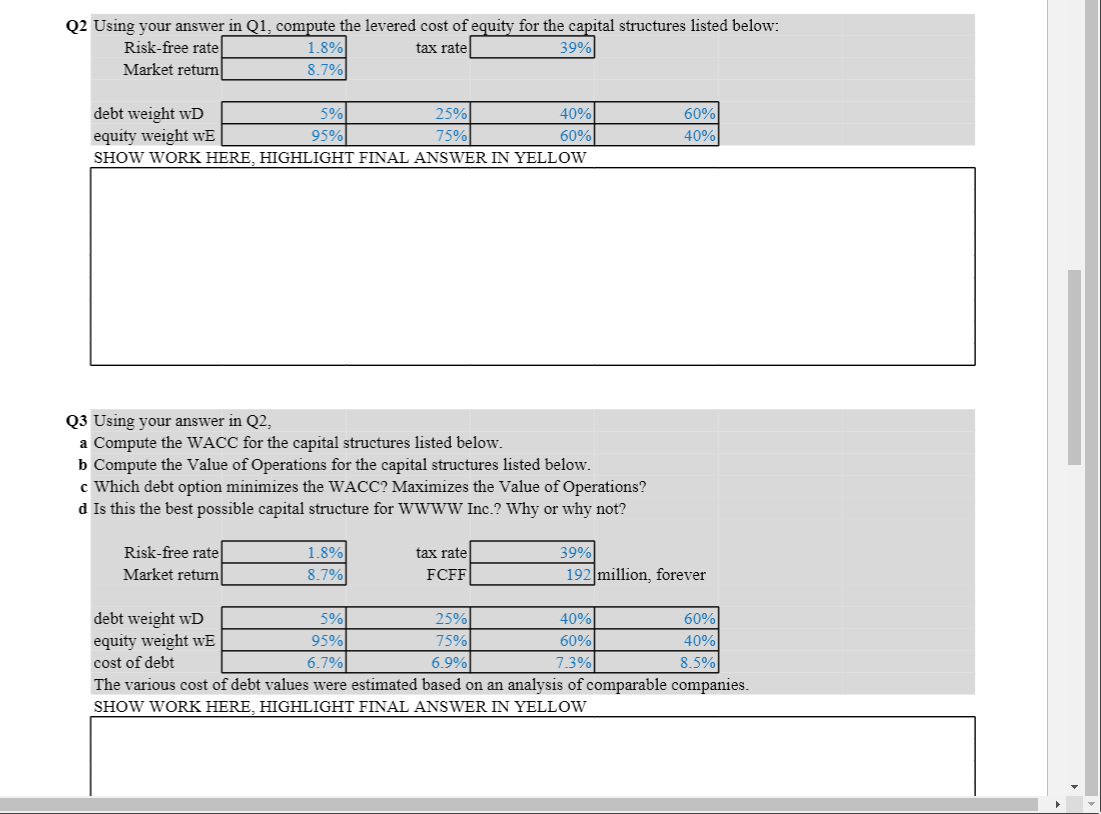

Question: Q2 Using your answer in Q1, compute the levered cost of equity for the capital structures listed below: Risk-free rate tax rate Market return det

Q2 Using your answer in Q1, compute the levered cost of equity for the capital structures listed below: Risk-free rate tax rate Market return det equ SHOW WORK HERE, HIGHLIGHT FINAL ANSWER IN YELLOW Q3 Using your answer in Q2, a Compute the WACC for the capital structures listed below. b Compute the Value of Operations for the capital structures listed below. c Which debt option minimizes the WACC? Maximizes the Value of Operations? d Is this the best possible capital structure for WWWW Inc.? Why or why not? \begin{tabular}{l|r|r|r|} Risk-free rate Market return & tax rate \\ \cline { 2 - 3 } & FCFF \end{tabular} debt weight w equity weight cost of debt The various cost of debt values were estimated based on an analysis of comparable companies. SHOW WORK HERE, HIGHLIGHT FINAL ANSWER IN YELLOW Q2 Using your answer in Q1, compute the levered cost of equity for the capital structures listed below: Risk-free rate tax rate Market return det equ SHOW WORK HERE, HIGHLIGHT FINAL ANSWER IN YELLOW Q3 Using your answer in Q2, a Compute the WACC for the capital structures listed below. b Compute the Value of Operations for the capital structures listed below. c Which debt option minimizes the WACC? Maximizes the Value of Operations? d Is this the best possible capital structure for WWWW Inc.? Why or why not? \begin{tabular}{l|r|r|r|} Risk-free rate Market return & tax rate \\ \cline { 2 - 3 } & FCFF \end{tabular} debt weight w equity weight cost of debt The various cost of debt values were estimated based on an analysis of comparable companies. SHOW WORK HERE, HIGHLIGHT FINAL ANSWER IN YELLOW

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts