Question: Q2. Write your calculations please. (20 points) VXX is the Ix vix futures ETF. ETF UVXY manages leverage of +1.5x of vix futures ETF (a

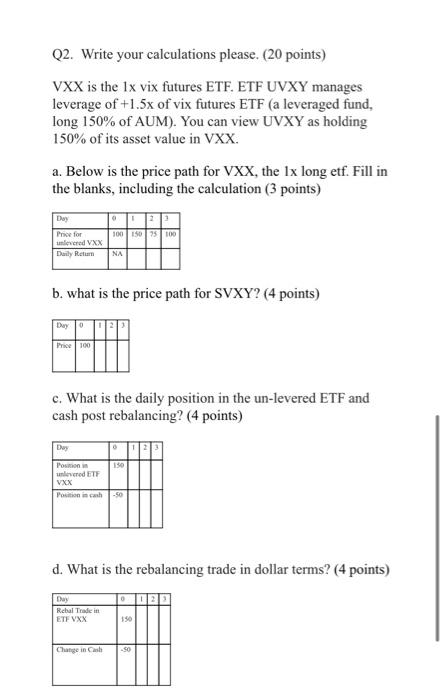

Q2. Write your calculations please. (20 points) VXX is the Ix vix futures ETF. ETF UVXY manages leverage of +1.5x of vix futures ETF (a leveraged fund, long 150% of AUM). You can view UVXY as holding 150% of its asset value in VXX. a. Below is the price path for VXX, the 1x long etf. Fill in the blanks, including the calculation (3 points) Day Pro for unlesered VXX Daily Return 012 100 150 100 NA b. what is the price path for SVXY? (4 points) Day 1 100 c. What is the daily position in the un-levered ETF and cash post rebalancing? (4 points) Day Pomon 150 und ETF VXX Position in cash-50 d. What is the rebalancing trade in dollar terms? (4 points) 0 Day Rehal Trade in ETF VXX 150 Change in Cash -50 Q2. Write your calculations please. (20 points) VXX is the Ix vix futures ETF. ETF UVXY manages leverage of +1.5x of vix futures ETF (a leveraged fund, long 150% of AUM). You can view UVXY as holding 150% of its asset value in VXX. a. Below is the price path for VXX, the 1x long etf. Fill in the blanks, including the calculation (3 points) Day Pro for unlesered VXX Daily Return 012 100 150 100 NA b. what is the price path for SVXY? (4 points) Day 1 100 c. What is the daily position in the un-levered ETF and cash post rebalancing? (4 points) Day Pomon 150 und ETF VXX Position in cash-50 d. What is the rebalancing trade in dollar terms? (4 points) 0 Day Rehal Trade in ETF VXX 150 Change in Cash -50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts