Question: Q2 You are evaluating a potential takeover target. A junior analyst on your team provided the target FCFF forecast below. In addition, you have information

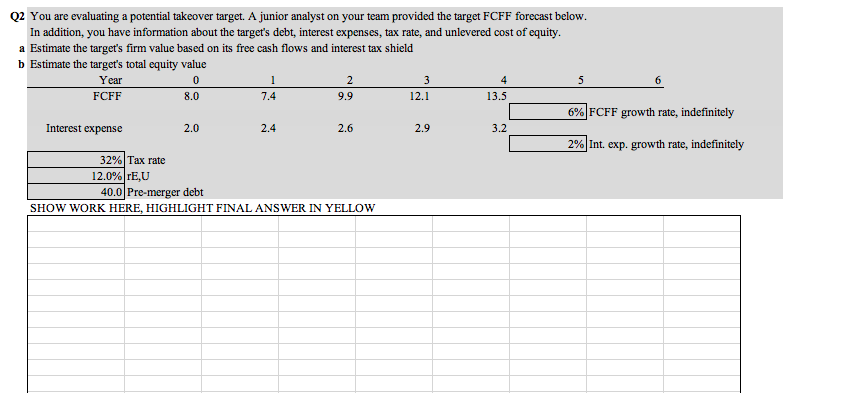

Q2 You are evaluating a potential takeover target. A junior analyst on your team provided the target FCFF forecast below. In addition, you have information about the target's debt, interest expenses, tax rate, and unlevered cost of equity. a Estimate the target's firm value based on its free cash flows and interest tax shield b Estimate the target's total equity value Year FCFF 8.0 9.9 12.1 13.5 6% FCFF growth rate, indefinitely Interest expense 2.0 - 2.4 2.6 2.9 3.2 3.2 2% Int. exp. growth rate, indefinitely 32% Tax rate 12.0% TEU 40.0 Pre-merger debt SHOW WORK HERE, HIGHLIGHT FINAL ANSWER IN YELLOW Q2 You are evaluating a potential takeover target. A junior analyst on your team provided the target FCFF forecast below. In addition, you have information about the target's debt, interest expenses, tax rate, and unlevered cost of equity. a Estimate the target's firm value based on its free cash flows and interest tax shield b Estimate the target's total equity value Year FCFF 8.0 9.9 12.1 13.5 6% FCFF growth rate, indefinitely Interest expense 2.0 - 2.4 2.6 2.9 3.2 3.2 2% Int. exp. growth rate, indefinitely 32% Tax rate 12.0% TEU 40.0 Pre-merger debt SHOW WORK HERE, HIGHLIGHT FINAL ANSWER IN YELLOW

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts