Question: Q20 PLEASE ANSWER CORRECTLY AND PROMPTLY!! SHOW ALL WORK!!! A company has just purchased a new delivery van. Now it is trying to decide whether

Q20 PLEASE ANSWER CORRECTLY AND PROMPTLY!! SHOW ALL WORK!!!

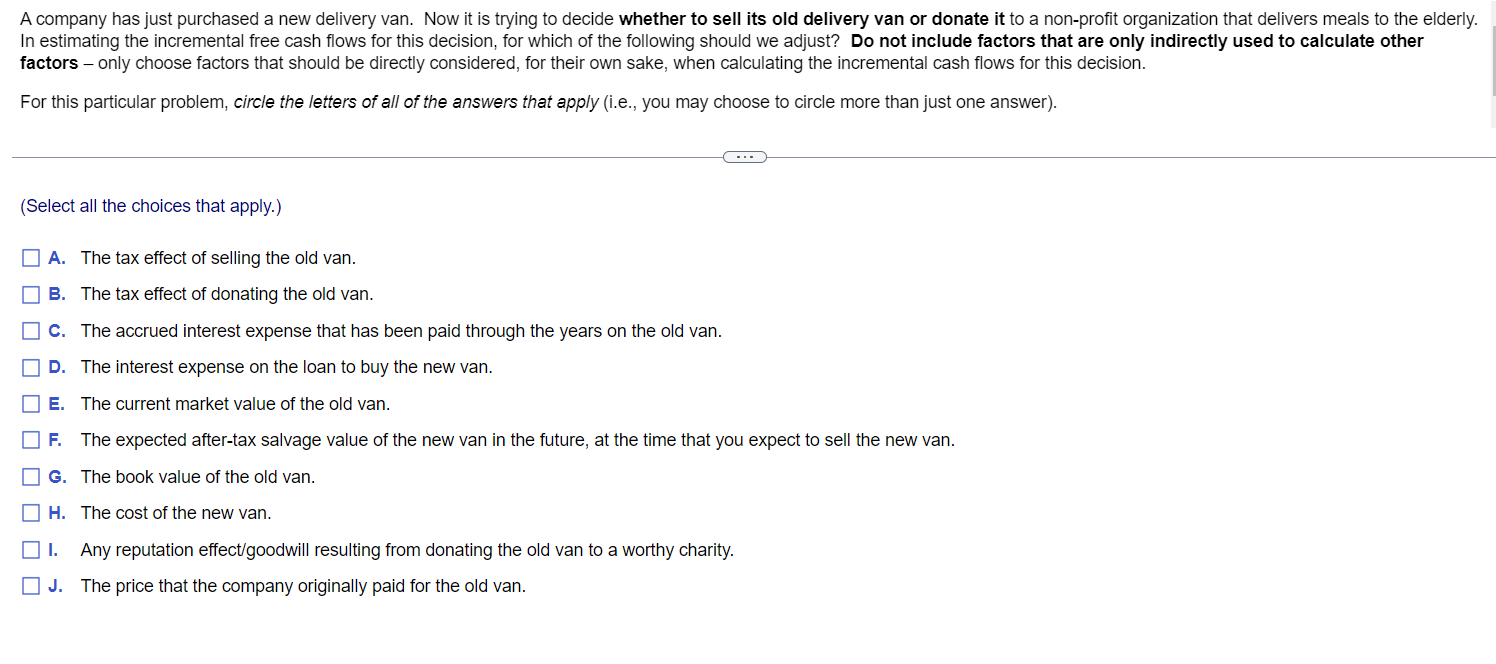

A company has just purchased a new delivery van. Now it is trying to decide whether to sell its old delivery van or donate it to a non-profit organization that delivers meals to the elderly. In estimating the incremental free cash flows for this decision, for which of the following should we adjust? Do not include factors that are only indirectly used to calculate other factors - only choose factors that should be directly considered, for their own sake, when calculating the incremental cash flows for this decision. For this particular problem, circle the letters of all of the answers that apply (i.e., you may choose to circle more than just one answer). (Select all the choices that apply.) A. The tax effect of selling the old van. B. The tax effect of donating the old van. C. The accrued interest expense that has been paid through the years on the old van. D. The interest expense on the loan to buy the new van. E. The current market value of the old van. F. The expected after-tax salvage value of the new van in the future, at the time that you expect to sell the new van. G. The book value of the old van. H. The cost of the new van. I. Any reputation effect/goodwill resulting from donating the old van to a worthy charity. J. The price that the company originally paid for the old van

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts