Question: q26-36 q When a note comes due, the difference between the amount borrowed and the amount repaid is: Muitiple Choice Face Value. Cash. Interest. Accounts

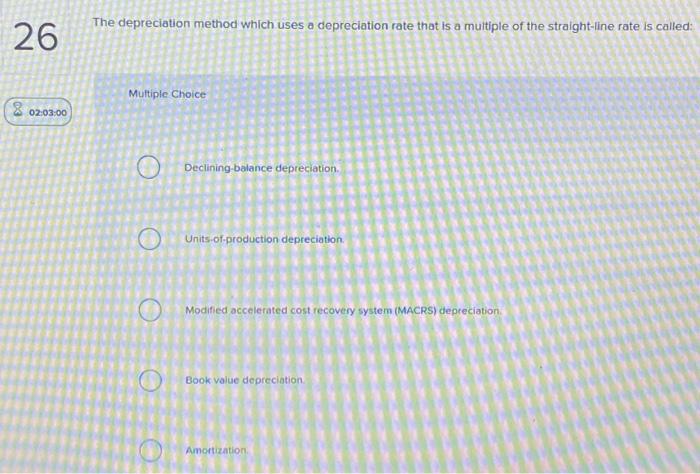

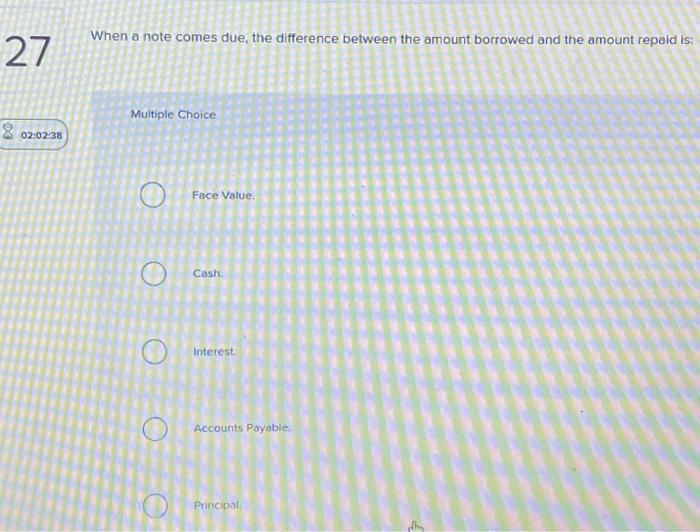

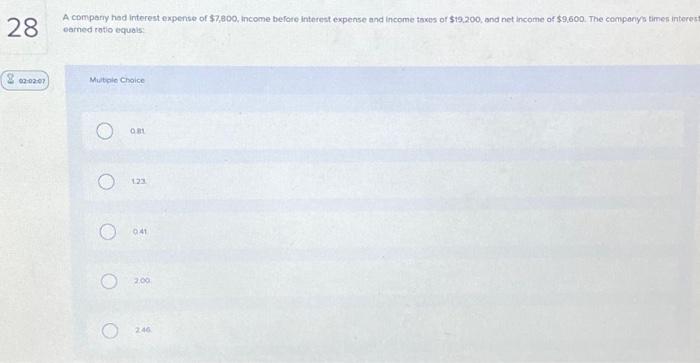

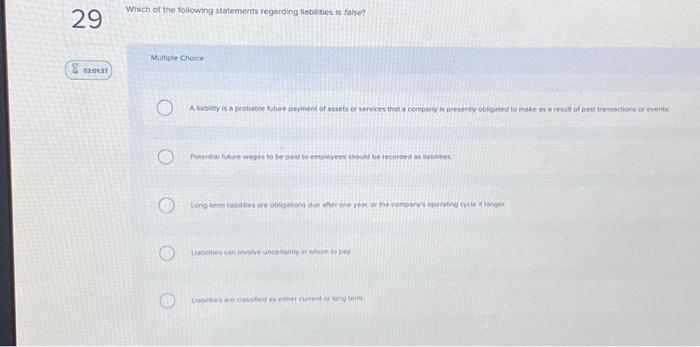

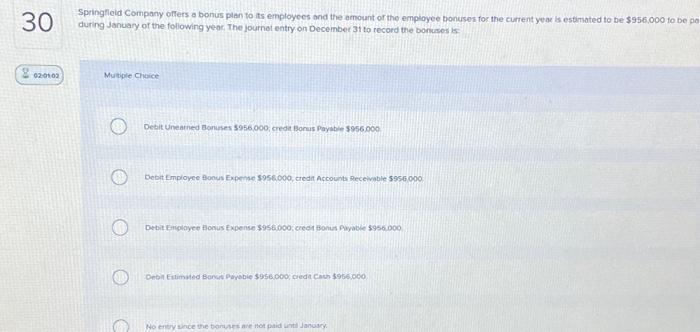

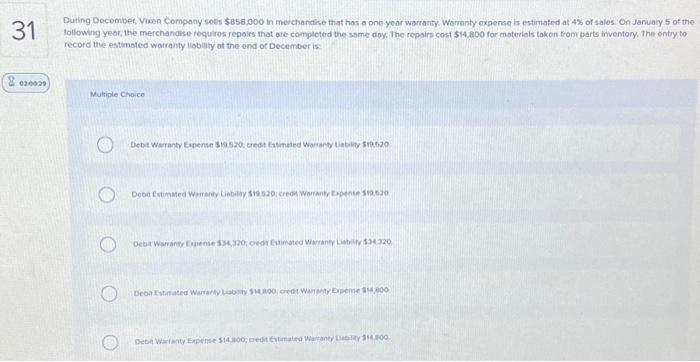

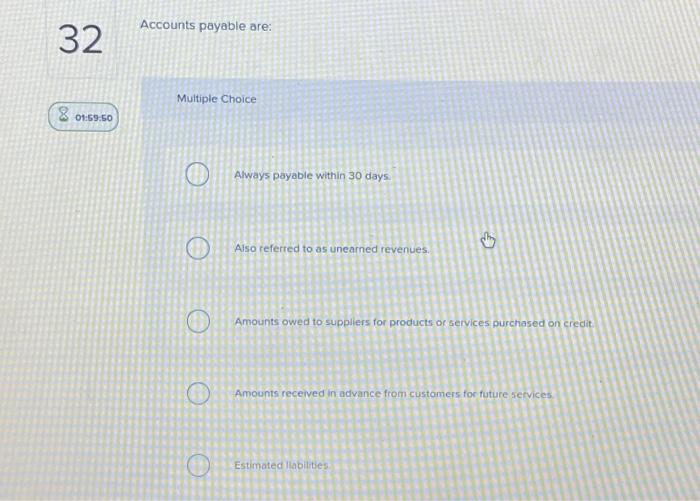

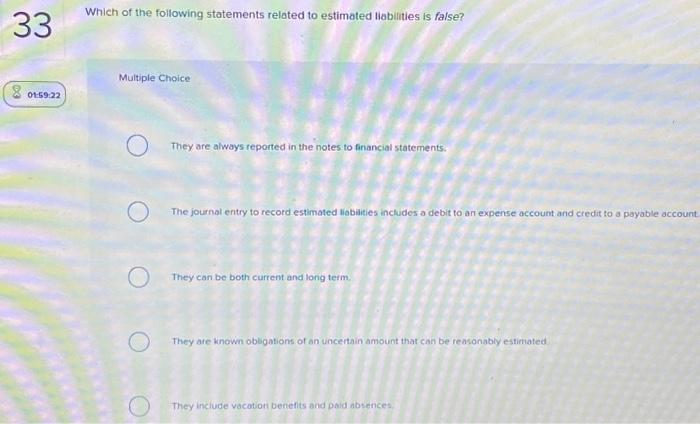

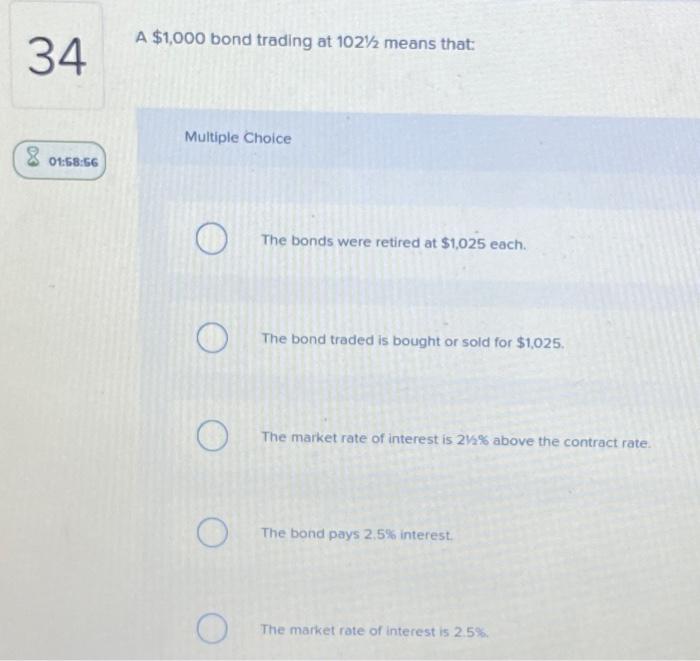

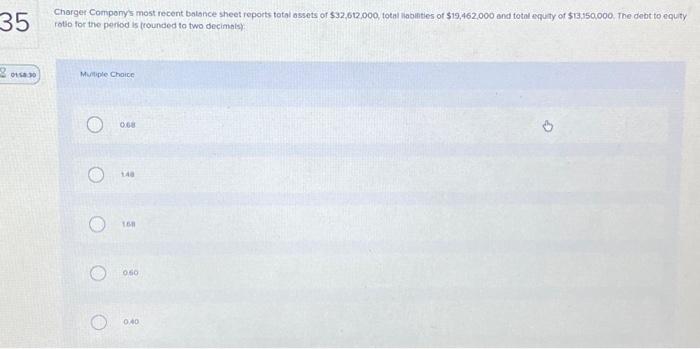

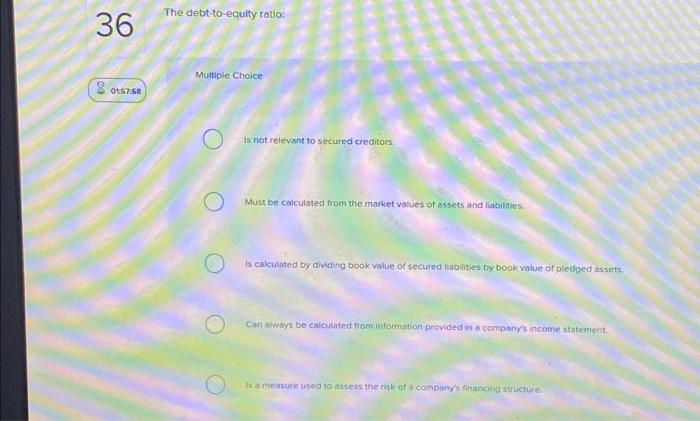

When a note comes due, the difference between the amount borrowed and the amount repaid is: Muitiple Choice Face Value. Cash. Interest. Accounts Payable. Principal The depreciation method which uses a depreciation rate that is a multiple of the straight-line rate is called: Muftiple Choice Declining balance depreciation. Units-of-production depreciation. Modified accelerated cost recovery system (MACRS) depreciation. Book value depreciation Amortization. Accounts payable are: Multiple Choice Always payable within 30 days. Also referred to as unearned revenues. Amounts owed to suppliers for products or services purchased on credit Amounts received in advance from customers for future setvices: Estimated liabilites Which of the following statements regerding liobit jes is fake? Muitiple Choice Labalies can incolve uncerainty in whom to by Charger Comporys's most recent balsnce sheet reports total assets of \\( \\$ 32,012,000 \\), total habinties of \\( \\$ 19,462,000 \\) and total equity of \\( \\$ 13,350,000 \\). The debt to equty rotio for the period is (rounded to two decimals): Muitiple Chaice oes 14. 181 050 0.40 Springfleid Company offers a bonus plan to its employees ond the amount or the employee bonuses for the current year is estimated to be \\( \\$ 956.000 \\) fo be p furing January of the following yeac, The journat entry on Decembec 31 to record the bonuses is: Mutble Cheice Debit Uneatned Bonuses \\( \\$ 956,000 \\), credit Bonas Payble \\( \\$ 956,000 \\). Debrt Employee fonus Expense \\( \\$ 956,000 \\), credi Accounts Receivable 5956,000 Debit Emplayee Bonus Expense \\$956 000; crech Bonus Axyate \\( \\$ 956.000 \\) Which of the following statements related to estimated liabilities is false? Multiple Choice They are always reported in the notes to financial statements. The journal entry to record estimated liabaities includes a debit to an expense account and credit to a payable account They can be both current and long term. They are known obbgations of an uncertain amount that can be reasonably estimated They inciude vacotion benefits and paid absences. A \\( \\$ 1,000 \\) bond trading at \\( 1021 / 2 \\) means that: Multiple Choice The bonds were retired at \\( \\$ 1,025 \\) each. The bond traded is bought or sold for \\( \\$ 1,025 \\). The market rate of interest is \\( 2 \\mathrm{~V} / 2 \\) above the contract rate. The bond pays \2,5 interest. The market rate of interest is \2.5. The debt-to-equity ratio: Multiple Choice is not relevant to secured creditors Must be calculated from the market values of assets and liabilities. is calculated by dividing book value of secured liablities by book value of plediged assets. Can alwoys be calculated from information provided in a companys income statement: Whameasure used to assess the risk of a companys financing structure During December, Vixen Company setss \\( \\$ 858,000 \\) in merchandise that has o one year warranty. Warrarty expense is estirnated at 43 of sales. On January 5 of the following year, the merchandise fequires repoirs that are completed the same doy. The repairs cost \\( \\$ 14 \\), 80o for moterlais taken from parts inventory, The entry to record the estimsted warranty liablity at the end of December is: Mutriple Choice A comparry had interest expense of \\( \\$ 7,800 \\), income before interest expense and income taxes of \\( \\$ 19.200 \\), and net income of \\( \\$ 9,600 \\). The compary/s times interes earned rotio equals: Mutpie Choice on 123. 041 200 246

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts