Question: Q2(a) UCSI developer is faced with a choice between two development alternatives for a toll bridge project: one large-scale proposal with higher costs but enabling

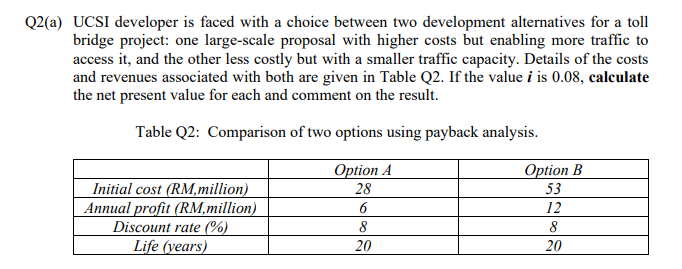

Q2(a) UCSI developer is faced with a choice between two development alternatives for a toll bridge project: one large-scale proposal with higher costs but enabling more traffic to access it, and the other less costly but with a smaller traffic capacity. Details of the costs and revenues associated with both are given in Table Q2. If the value i is 0.08, calculate the net present value for each and comment on the result. Table Q2: Comparison of two options using payback analysis. Initial cost (RM million) Annual profit (RM,million) Discount rate (%) Life (years) Option A 28 6 8 20 Option B 53 12 8 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts