Question: Q3 (25 points): Consider a decision maker with the utility function, u(x) = 1-e-x/R. Assume that the risk tolerance R for this particular decision maker

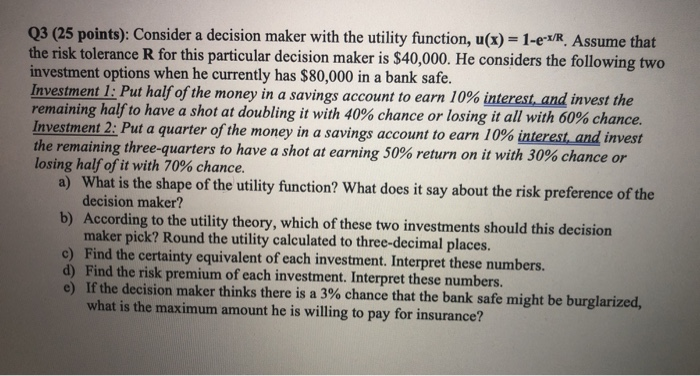

Q3 (25 points): Consider a decision maker with the utility function, u(x) = 1-e-x/R. Assume that the risk tolerance R for this particular decision maker is $40,000. He considers the following two investment options when he currently has $80,000 in a bank safe. Investment 1: Put half of the money in a savings account to earn 10% interest, and invest the remaining half to have a shot at doubling it with 40% chance or losing it all with 60% chance. Investment 2: Put a quarter of the money in a savings account to earn 10% interest, and invest the remaining three-quarters to have a shot at earning 50% return on it with 30% chance or losing half of it with 70% chance. a) What is the shape of the utility function? What does it say about the risk preference of the decision maker? b) According to the utility theory, which of these two investments should this decision maker pick? Round the utility calculated to three-decimal places. c) Find the certainty equivalent of each investment. Interpret these numbers. d) Find the risk premium of each investment. Interpret these numbers. e) If the decision maker thinks there is a 3% chance that the bank safe might be burglarized, what the maximum amount he is willing to pay for insurance? Q3 (25 points): Consider a decision maker with the utility function, u(x) = 1-e-x/R. Assume that the risk tolerance R for this particular decision maker is $40,000. He considers the following two investment options when he currently has $80,000 in a bank safe. Investment 1: Put half of the money in a savings account to earn 10% interest, and invest the remaining half to have a shot at doubling it with 40% chance or losing it all with 60% chance. Investment 2: Put a quarter of the money in a savings account to earn 10% interest, and invest the remaining three-quarters to have a shot at earning 50% return on it with 30% chance or losing half of it with 70% chance. a) What is the shape of the utility function? What does it say about the risk preference of the decision maker? b) According to the utility theory, which of these two investments should this decision maker pick? Round the utility calculated to three-decimal places. c) Find the certainty equivalent of each investment. Interpret these numbers. d) Find the risk premium of each investment. Interpret these numbers. e) If the decision maker thinks there is a 3% chance that the bank safe might be burglarized, what the maximum amount he is willing to pay for insurance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts