Question: Q3 a. Financial Accounting Question Ment Paper().pdf 1000 ! Question a) On 31 October 2021, Wicklow ple (Wickdow, a company with a 30 November year

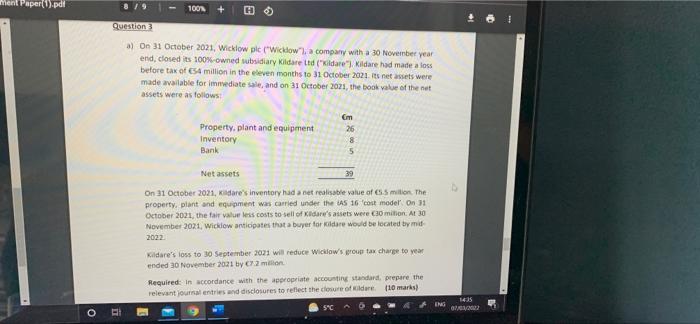

Ment Paper().pdf 1000 ! Question a) On 31 October 2021, Wicklow ple (Wickdow", a company with a 30 November year end, closed its 100%-owned subsidiary Kildare tid (Kildare"), Kildare had made a loss before tax of 654 million in the eleven months to 31 October 2021. is net assets were made available for immediate sale, and on 31 October 2021, the book value of the net assets were as follows: Property, plant and equipment Inventory Bank Em 26 8 5 Net assets On 31 October 2021, Kildare's inventory had a net realisable value of S. million. The property, plant and equipment was carried under the CAS 16 cost model on 31 October 2001, the fair value les costs to sell of Kidane's assets were comition. At 30 November 2021, Wicklow anticipates that a buyer for Kildare would be located by mu 2002 Kildare's loss to 30 September 2021 will reduce Wicklow's group tax charge to year ended 30 November 2021 by 2 milion Required: in accordance with the appropriate accounting standard prepare the relevant journal entries and disclosures to reflect the closure of kilder 110 marks) 5C 1435 ING GO o Ment Paper().pdf 1000 ! Question a) On 31 October 2021, Wicklow ple (Wickdow", a company with a 30 November year end, closed its 100%-owned subsidiary Kildare tid (Kildare"), Kildare had made a loss before tax of 654 million in the eleven months to 31 October 2021. is net assets were made available for immediate sale, and on 31 October 2021, the book value of the net assets were as follows: Property, plant and equipment Inventory Bank Em 26 8 5 Net assets On 31 October 2021, Kildare's inventory had a net realisable value of S. million. The property, plant and equipment was carried under the CAS 16 cost model on 31 October 2001, the fair value les costs to sell of Kidane's assets were comition. At 30 November 2021, Wicklow anticipates that a buyer for Kildare would be located by mu 2002 Kildare's loss to 30 September 2021 will reduce Wicklow's group tax charge to year ended 30 November 2021 by 2 milion Required: in accordance with the appropriate accounting standard prepare the relevant journal entries and disclosures to reflect the closure of kilder 110 marks) 5C 1435 ING GO o

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts