Question: Q3. a) Using supply and demand for both the bond market and money market, show how an economic recession would affect interest rates and the

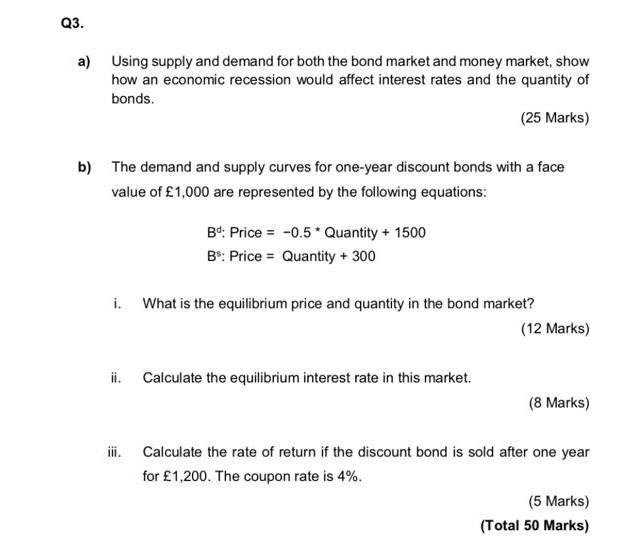

Q3. a) Using supply and demand for both the bond market and money market, show how an economic recession would affect interest rates and the quantity of bonds. (25 Marks) b) The demand and supply curves for one-year discount bonds with a face value of 1,000 are represented by the following equations: BO: Price = -0.5* Quantity + 1500 BS: Price = Quantity + 300 i. What is the equilibrium price and quantity in the bond market? (12 Marks) ii. Calculate the equilibrium interest rate in this market. (8 Marks) iii. Calculate the rate of return if the discount bond is sold after one year for 1,200. The coupon rate is 4%. (5 Marks) (Total 50 Marks) Q3. a) Using supply and demand for both the bond market and money market, show how an economic recession would affect interest rates and the quantity of bonds. (25 Marks) b) The demand and supply curves for one-year discount bonds with a face value of 1,000 are represented by the following equations: BO: Price = -0.5* Quantity + 1500 BS: Price = Quantity + 300 i. What is the equilibrium price and quantity in the bond market? (12 Marks) ii. Calculate the equilibrium interest rate in this market. (8 Marks) iii. Calculate the rate of return if the discount bond is sold after one year for 1,200. The coupon rate is 4%. (5 Marks) (Total 50 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts