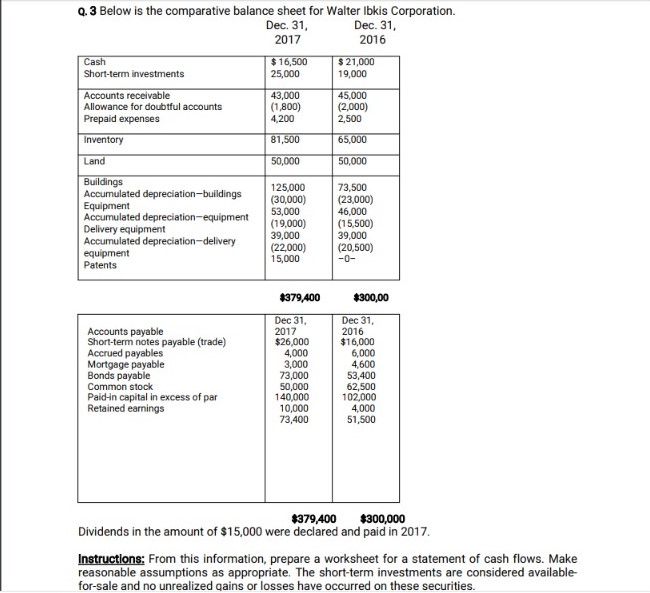

Question: Q.3 Below is the comparative balance sheet for Walter Ibkis Corporation. Dec. 31, Dec. 31, 2017 2016 Cash Short-term investments $ 16,500 25,000 $ 21,000

Q.3 Below is the comparative balance sheet for Walter Ibkis Corporation. Dec. 31, Dec. 31, 2017 2016 Cash Short-term investments $ 16,500 25,000 $ 21,000 19,000 Accounts receivable Allowance for doubtful accounts Prepaid expenses 43,000 (1,800) 4,200 45,000 (2,000) 2,500 Inventory 81,500 65,000 Land 50,000 50,000 Buildings Accumulated depreciation-buildings Equipment Accumulated depreciation-equipment Delivery equipment Accumulated depreciation-delivery equipment Patents 125,000 (30,000) 53,000 (19,000) 39,000 (22,000) 15,000 73,500 (23,000) 46,000 (15,500) 39,000 (20,500) $379,400 $300,00 Accounts payable Short-term notes payable (trade) Accrued payables Mortgage payable Bonds payable Common stock Paid-in capital in excess of par Retained earnings Dec 31, 2017 $26,000 4,000 3,000 73,000 50,000 140,000 10,000 73,400 Dec 31, 2016 $16,000 6,000 4,600 53,400 62,500 102,000 4,000 51,500 $379,400 $300,000 Dividends in the amount of $15,000 were declared and paid in 2017. Instructions: From this information, prepare a worksheet for a statement of cash flows. Make reasonable assumptions as appropriate. The short-term investments are considered available for-sale and no unrealized gains or losses have occurred on these securities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts