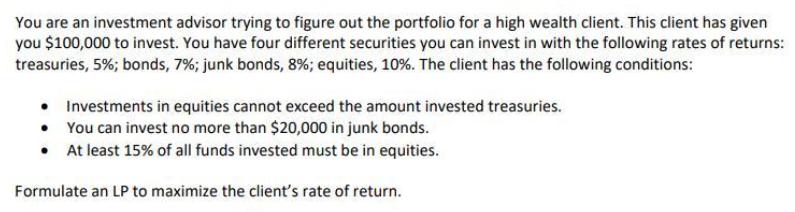

Question: You are an investment advisor trying to figure out the portfolio for a high wealth client. This client has given you $100,000 to invest.

You are an investment advisor trying to figure out the portfolio for a high wealth client. This client has given you $100,000 to invest. You have four different securities you can invest in with the following rates of returns: treasuries, 5%; bonds, 7%; junk bonds, 8% ; equities, 10%. The client has the following conditions: Investments in equities cannot exceed the amount invested treasuries. You can invest no more than $20,000 in junk bonds. At least 15% of all funds invested must be in equities. Formulate an LP to maximize the client's rate of return.

Step by Step Solution

3.37 Rating (156 Votes )

There are 3 Steps involved in it

To formulate the LP to maximize the clients rate of return we need to define decision variables and ... View full answer

Get step-by-step solutions from verified subject matter experts