Question: Q3 (Essential to cover a, b, d, e) Consider an investment universe consisting of three assets with the following characteristics: E(11) = 8% E(12) =

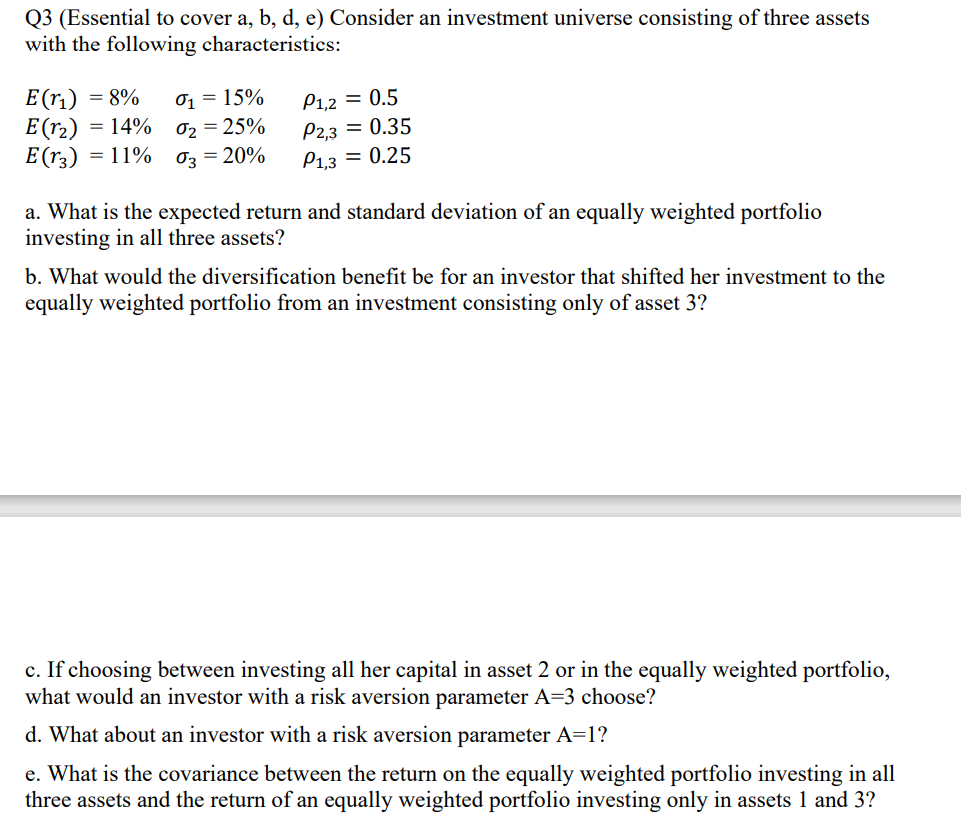

Q3 (Essential to cover a, b, d, e) Consider an investment universe consisting of three assets with the following characteristics: E(11) = 8% E(12) = 14% E(13) = 11% 01 = 15% 02 = 25% 03 = 20% P1,2 = 0.5 P2,3 = 0.35 P1,3 = 0.25 a. What is the expected return and standard deviation of an equally weighted portfolio investing in all three assets? b. What would the diversification benefit be for an investor that shifted her investment to the equally weighted portfolio from an investment consisting only of asset 3? c. If choosing between investing all her capital in asset 2 or in the equally weighted portfolio, what would an investor with a risk aversion parameter A=3 choose? d. What about an investor with a risk aversion parameter A=1? e. What is the covariance between the return on the equally weighted portfolio investing in all three assets and the return of an equally weighted portfolio investing only in assets 1 and 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts