Question: Q3 (Essential to cover) In this problem the term structure of interest rates is flat at 8%. The following bonds and liabilities are given: -

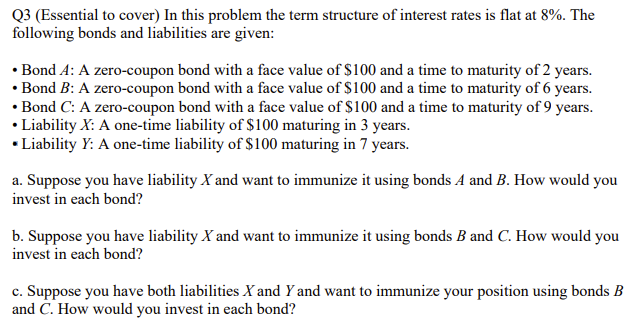

Q3 (Essential to cover) In this problem the term structure of interest rates is flat at 8%. The following bonds and liabilities are given: - Bond A: A zero-coupon bond with a face value of $100 and a time to maturity of 2 years. - Bond B : A zero-coupon bond with a face value of $100 and a time to maturity of 6 years. - Bond C : A zero-coupon bond with a face value of $100 and a time to maturity of 9 years. - Liability X : A one-time liability of $100 maturing in 3 years. - Liability Y : A one-time liability of $100 maturing in 7 years. a. Suppose you have liability X and want to immunize it using bonds A and B. How would you invest in each bond? b. Suppose you have liability X and want to immunize it using bonds B and C. How would you invest in each bond? c. Suppose you have both liabilities X and Y and want to immunize your position using bonds B and C. How would you invest in each bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts