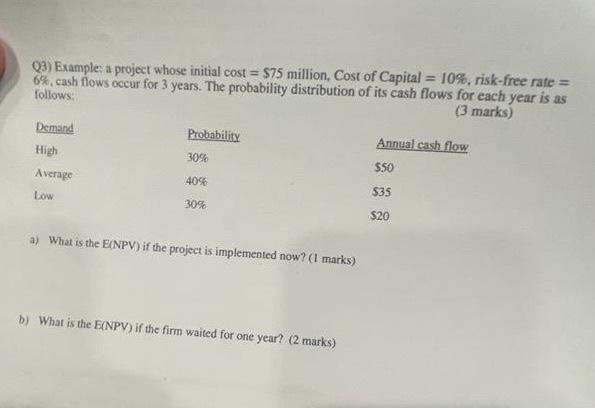

Question: Q3) Example: a project whose initial cost =$75 million, Cost of Capital =10%, risk-free rate = 6%, cash flows occur for 3 years. The probability

Q3) Example: a project whose initial cost =$75 million, Cost of Capital =10%, risk-free rate = 6\%, cash flows occur for 3 years. The probability distribution of its cash flows for each year is as follows: (3 marks) a) What is the E(NPV) if the project is implemented now? (I marks) b) What is the E(NPV) if the firm waited for one year? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts