Question: Q3 Implement the Monte Carlo Simulation method by writing a program in your favourite programming language or Excel using equation 20.17 on page 471 of

Q3 Implement the Monte Carlo Simulation method by writing a program in your favourite programming language or Excel using equation 20.17 on page 471 of Hulls book.

Financial Mathematics I: options, futures and other derivatives (9th edition) Chapter 17: Options on stock indices and currencies, Chapter 18: Futures options ,Chapter 21: Basic numerical procedures ,Chapter 27: More on models and numerical procedures please use equation 20.17

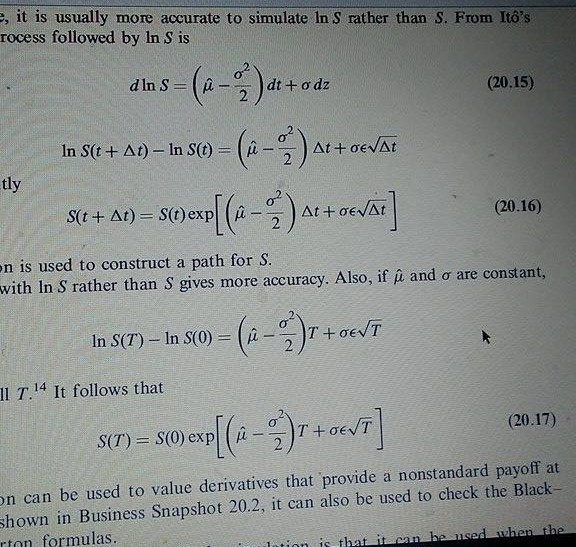

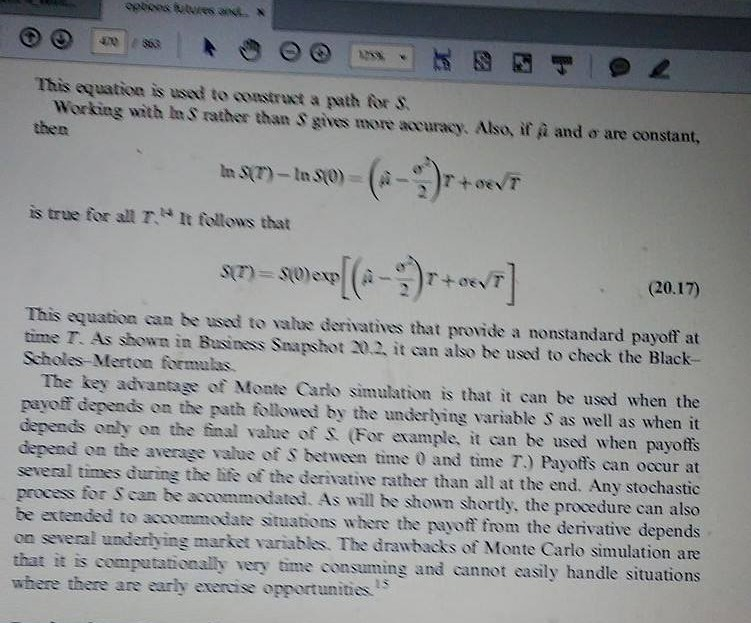

e, it is usually more accurate to simulate ln s rather than S. From Ito's rocess followed by In S is (20.15) dt o dz d ln S tly (20.16) is used to construct a path for S. are constant, with In S rather than S gives more accuracy. Also, if p and o T oEVT ln SOTO-In S00) ll T.14 It follows that (20.17) OE S(T) S(0) exp on can be used to value derivatives that provide a nonstandard payoff at shown in Business Snapshot 20.2, it can also be used to check the Black formulas be ased then the lotion is that can

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts