Question: Q3. There are two assets: a mutual fund tracking the S&P 500 index and gold. If inflation stays low (during the next year) the fund

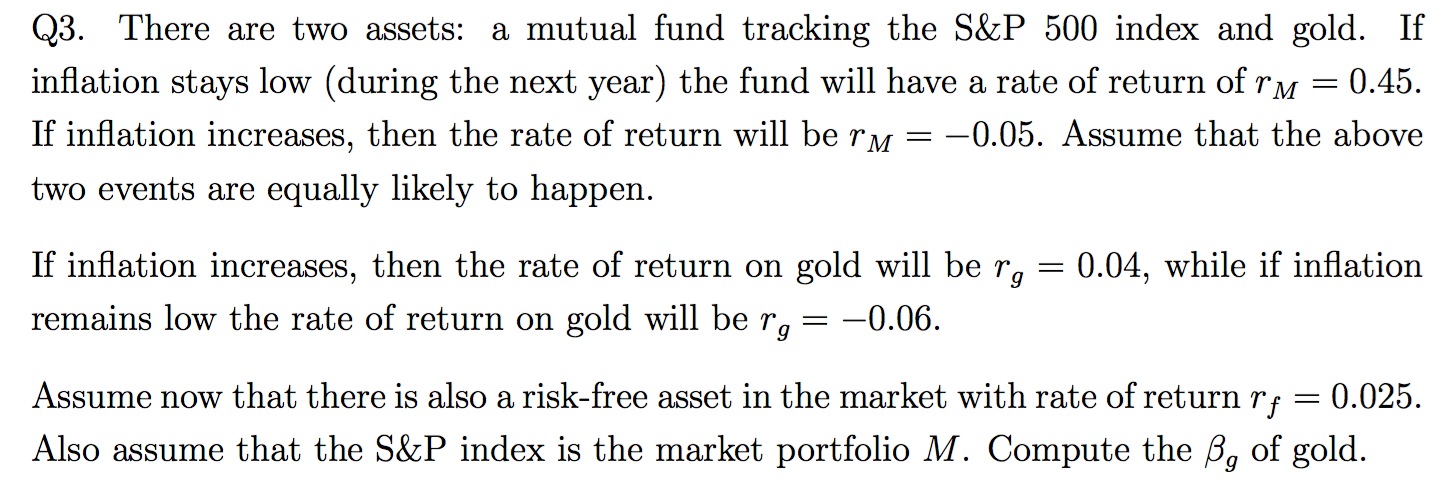

Q3. There are two assets: a mutual fund tracking the S&P 500 index and gold. If inflation stays low (during the next year) the fund will have a rate of return of rm = 0.45. If inflation increases, then the rate of return will be rm = -0.05. Assume that the above two events are equally likely to happen. If inflation increases, then the rate of return on gold will be r, = 0.04, while if inflation remains low the rate of return on gold will be r,= -0.06. Assume now that there is also a risk-free asset in the market with rate of return rf = 0.025. Also assume that the S&P index is the market portfolio M. Compute the B, of gold

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock